These Related Stories

XYPN's Financial Planning Process

Share this

Why should you adopt XYPN's financial planning process? Valid question, and as XYPN's Financial Planning & Process coach, you'd better believe I have a solid answer for you.

1. To establish a client-centric financial planning process.XYPN members have a starting point for adaptability through our turnkey financial planning process. We will help you meet the client where they are by focusing on client inclusion; this will create buy-in and increase financial plan implementation.

Our process will help you develop and define your ideal client while evaluating the current services you are providing. I will explore the financial planning process timeline below as one way to build a client-focused service model.

2. To illustrate the value of an ongoing client-advisor relationship.

Our process helps you set the stage for a productive, long-term client-advisor relationship. We spend time refining how you communicate your value to prospects and clients beyond an initial financial planning engagement.

A client service calendar is a great way to communicate your expertise and organize your service offerings. Check out my blog entitled “Refining Your Client Service Model” if you are interested in building and implementing a service calendar of your own.

3. To find efficiencies with repeatable processes.

You are able to regain control of your time and increase your productivity by leveraging our existing workflows and templates. Our process will help you set boundaries and manage your calendar so you can spend more time engaging with prospects and existing clients.

We demonstrate how to enhance your existing financial planning process and client experience to better serve your niche market through webinars and group coaching formats.

In a previous blog, I built a framework for creating workflows. (If you are a current XYPN member, make sure to check out our 9-part Workflow Series. The Workflow Series infographic is posted on the Member Forums if you need a quick refresher.)

4. To leverage and adapt resources for your ideal client and business model.

We are able to synthesize financial planning resources that are spread across XYPN members and rely on the XYPN community to determine current and best practices. Some of the financial planning resources include templated emails, agendas, and infographics.

Our partnership with fpPathfinder is a new and exciting member benefit. As an advisor, it can be challenging to keep up with the ever-evolving rules and regulations. fpPathfinder is designed to provide you with 35+ decision-oriented flowcharts to help you quickly and easily solve common planning situations.

You can also leverage 15+ issue-based checklists centered around major life events to facilitate client conversations. New flowcharts and checklists are added each month and updated as needed. Learn more about the Essentials Membership (included with XYPN membership) and Deluxe Membership packages.

5. To build sustainable and profitable advice-focused planning firms.

Our process demonstrates how to build a profitable business solely on financial planning engagement fees. We show you how to calculate and set customized fee structures to better serve your ideal client regardless of net worth. Check out AdvicePay’s fee calculator.

We also provide access to annual benchmarking data and tech-focused surveys to summarize what and how other members charge for the services they provide.

Building Your Initial Financial Planning Process

Once you have aligned your fees and service offerings, the next step is building an initial financial planning process. On my coaching calls, members always ask about building workflows, streamlining work processes, and opportunities automation.

However, I need to make sure you have a solid foundation on which to build your practice first. Without this step, your financial planning process may be challenging to implement successfully.

What is the initial process? I define it as the first 12 weeks of your client(s) experience at your firm. From the qualifying meeting through the financial plan delivery meeting, or alternatively, the start of an ongoing relationship. Advisors can be so focused on closing a prospect and quickly moving through onboarding that it affects the overall process negatively from the beginning.

A timeline that captures the first 12 weeks is a potential strategy to communicate your processes to prospects and clients. An example is below for your consideration.

(Are you an XYPN member? Make sure to download the template here.)

Do you have your initial process outlined? It’s important to write it down and stick to it. In order to build this, you must:

- Identify the number of meetings you want to hold (i.e., 1 - 6)

- Define your overall process timeline (i.e, 10 weeks, 12 weeks, 6 months)

- Specify how many days or weeks between each meeting

- Set expectations around meeting length

- Clearly describe each meeting and what you hope to accomplish

I put together some alternative meeting names for your marketing considerations:

- Qualifying Meeting, or:

- Initial Consultation

- Consultation Call

- Learn More Call

- Prospect Meeting, or:

- Are We a Fit?

- Proposal Meeting

- Discovery Meeting, or:

- Get to Know You

- Get Acquainted

- Get Organized Meeting, or:

- Let’s “GO”

- Data Gathering

- Explore Possibilities, or:

- Future Objectives

- Goals & Possibilities Meeting

- Strategy Meeting

- Plan Design

- Plan Delivery Meeting, or:

- Implement Plan

- Plan Presentation

- Ongoing Financial Planning, or:

- Monitoring

- Plan Implementation

- Ongoing Support

Our Financial Planning Process in Action

Once you have the structure, update the colors, add your firm logo, and consider branding the overall process.

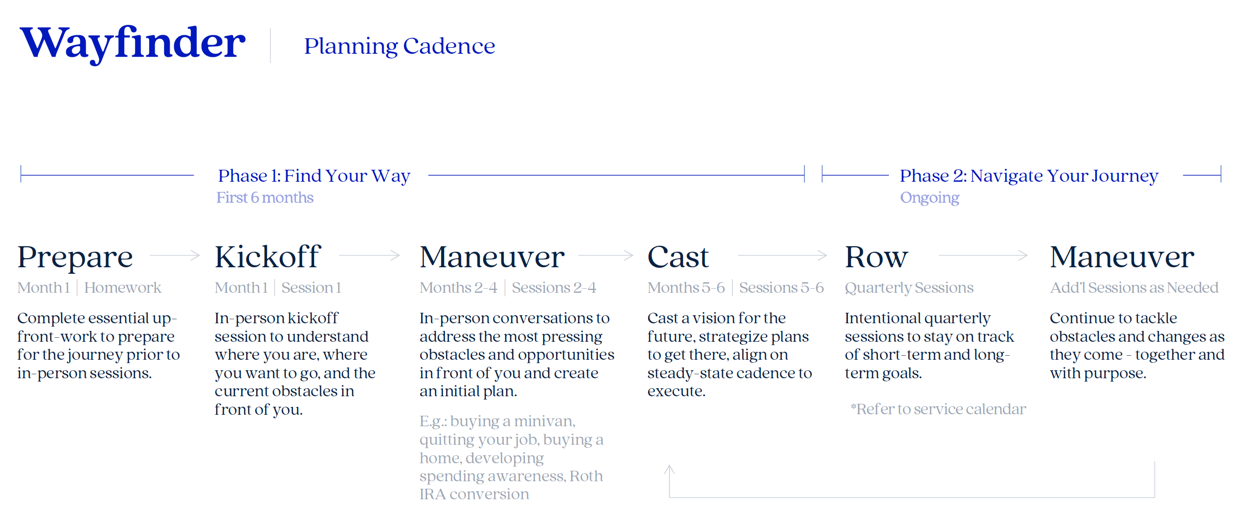

XYPN member Russ Ford, founder of Wayfinder Financial, branded his process using words like Embark, Cast, Row, and Maneuver. Another member, Brent Hoskins, founder of Focal Point Financial Group, branded his planning process through the acronym L.A.S.E.R. This is a great way to set yourself apart from other financial planners and establish a brand. I connected with Russ and Brent to understand more about what went into creating their unique processes.

Russ Ford | Wayfinder Financial

It’s kind of ironic that my processes are being highlighted by XYPN because my website’s process page from day one last July has said: “I don’t have a fancy 7-step process.” Quite frankly, this is B.S.! Let’s just say I’ve changed some things since then, and I’m working on a redesign of that page. At least I can laugh about it now—ha!

It’s kind of ironic that my processes are being highlighted by XYPN because my website’s process page from day one last July has said: “I don’t have a fancy 7-step process.” Quite frankly, this is B.S.! Let’s just say I’ve changed some things since then, and I’m working on a redesign of that page. At least I can laugh about it now—ha!

To rewind and explain how I went from launching with that process explanation to now with a process that gets more and more regimented by the day, I’ll offer this: The heart behind my explanations on the process page still rings true. I dive really, really deep into life with my clients, and life is messy. That’s what I love doing. That’s what I’m fulfilled by. And that’s why I created Wayfinder—to do exactly that. But what I learned in the first few months involve two points:

- I hadn’t even gotten to a high number of clients yet and I was already feeling completely crazy. I knew I couldn’t survive and grow while recreating the wheel for every client.

- Kitces said it best at #XYPNLIVE (I’m paraphrasing): You can only get really good at customizing a client experience if you have a repeatable and efficient blueprint you’re using as the base. In fact, the more repeatable and efficient you get, the better you can then get at customizing and going above and beyond for your clients.

I’m laughing now about how drastically I’ve changed my mantra on processes since my launch in July, but that—constantly learning, recognizing when you’re wrong, and implementing changes – is what any of us who are serious about this profession should be doing, right?

When thinking through how to create my repeatable processes, what I noticed is that everyone coming to me had a life and money issue they were coming in with which they wanted to make sure was addressed prior to anything else in the planning process. These were things like “What should we reasonably budget for our next home purchase?” to “Should we buy a new minivan or wait?” to “I want to change jobs—what can I afford to give up?” That looked different for everybody, which meant non-repeatable processes up to that point. And it also meant their minds were pre-occupied if I didn’t address those items before moving on to deeper conversations.

So, I tried to balance the best of both worlds into a repeatable process—first addressing the top-of-mind client issues and usually some no-brainer, time-sensitive money moves that I brought to the table, then circling back to deeper life and long-term planning conversations that aren’t quite as tangible. What I came up with is represented by my planning cadence visual:

- My Kickoff Session serves as a long and deep conversation where we’re reviewing their financial picture based on the PreciseFP questionnaire I had them complete, I’m asking them clarifying questions, and we’re mutually deciding on some of the top-of-mind priorities or “maneuvers” we should cover in the next few meetings and creating those agendas.

- Then, over the next few months, we have maneuver sessions addressing all of those priorities. After that, the client feels like we’ve cut through a lot of the noise, gotten organized, and many some tangible changes that feel good to them because we’ve got a pretty workable one-page plan, and it gives me license to say, “let’s take a step back and cast a bigger vision for the journey long-term, not just with these money maneuvers, but with life and how we orient our money journey around that.”

- And that point at the end of the first six months is what I call the “Cast” sessions. I have them work on Kinder’s 3 questions, we discuss their answers, we review where we’ve come from, and what we’ve accomplished on our journey thus far. I get feedback from them, and we cast a bigger vision for the future and set some goals. At this point, we all feel really good about moving into my second phase which involves quarterly “Row” sessions and a service calendar where we’re constantly checking in our progress and making maneuvers as needed.

Brent Hoskins, CFP®, RICP® | Focal Point Financial Group

I launched Focal Point Financial Group back in June of 2018. Prior to launching my own firm, I had worked for larger financial service companies helping clients mostly with their investments. Over those 20 years, I found a common element or theme with the people I was helping: People certainly don’t try to make bad money choices, but when you make financial decisions in a vacuum without considering your entire financial picture, bad decisions can often be the unintended result.

I launched Focal Point Financial Group back in June of 2018. Prior to launching my own firm, I had worked for larger financial service companies helping clients mostly with their investments. Over those 20 years, I found a common element or theme with the people I was helping: People certainly don’t try to make bad money choices, but when you make financial decisions in a vacuum without considering your entire financial picture, bad decisions can often be the unintended result.

Hence, Focal Point Financial Group was formed. My goal is to help people find their financial focus, understand the relationship and interconnectedness of the various moving parts of their finances, and then make well-informed decisions with their end-goals and big picture in mind.

Many people I serve have never worked with a financial planner before or maybe they’ve only worked with a broker or advisor with their investments. It can be intimidating for clients as they start this new process of holistic planning. To help folks understand my path for delivering advice and to help me execute a consistent experience with clients I came up with my L.A.S.E.R. process. With my firm built around the idea of “focus”, I felt that a laser was a great illustration of focus in action. My L.A.S.E.R. process lays out what to expect as you onboard as a new client with me. It helps people know where we are headed, the stops along the way, and how long it will take to get there. It has also helped me explain the importance of both our roles (client & planner) in the financial planning process.

Many people I serve have never worked with a financial planner before or maybe they’ve only worked with a broker or advisor with their investments. It can be intimidating for clients as they start this new process of holistic planning. To help folks understand my path for delivering advice and to help me execute a consistent experience with clients I came up with my L.A.S.E.R. process. With my firm built around the idea of “focus”, I felt that a laser was a great illustration of focus in action. My L.A.S.E.R. process lays out what to expect as you onboard as a new client with me. It helps people know where we are headed, the stops along the way, and how long it will take to get there. It has also helped me explain the importance of both our roles (client & planner) in the financial planning process.

Three Real Benefits of a Process Timeline

1. You are able to set expectations.Prospects may not understand what you mean when you allude to a financial planning process. Depending on their experience with prior advisors, they may assume it involves transferring assets, an investment plan, and an annual or semi-annual meeting.

Spend time reviewing your process to set expectations around what they may experience during the first few months. This is critical in building trust and helping the client(s) feel comfortable with their new engagement. When done correctly, meetings will rarely go over the designated time and there will be an understanding of what should be accomplished in each meeting.

If your process is three months, you should be able to consistently complete the meeting flows and onboarding during this window. Only with unique client circumstances should the process extend beyond what you have set in your timeline.

2. You can build relevant workflows for your business.

When you have your initial process developed, building workflows becomes much easier. You are able to organize a workflow series that takes you through the initial consultation all the way to plan delivery. This may be a unique workflow for each meeting that captures your pre-work and follow-up accurately. Without this process timeline, you may build workflows with arbitrary deadlines leading to inefficiencies. Imagine a world where you had a 3-month process built in your CRM that you could move clients through efficiently and seamlessly. All of this hard work will lead to a consistent, scalable process.

3. You can develop client deliverables.

You are also able to build and customize client deliverables associated with each meeting in your process timeline. For example, the Get Organized Meeting, is a favorite among XYPN members. Once you establish your meeting cadence, you are able to create a suite of deliverables: email templates, agendas, infographics and, visuals. If you are a current member, make sure to check out the Financial Planning Resources for other downloads. Here is a sample Get Organized Meeting email:

Hello (Client),

We made a lot of great progress during our Discovery Meeting last week. Our next meeting, the Get Organized Meeting, is about 90 minutes and can be scheduled here: (Insert Calendly link). I would love to get this on the calendar in the next 2 weeks if your schedule allows.

I attached a draft agenda for your review and consideration. If you have any changes, I will revise it before we meet. I also attached a visual for how I typically run these meetings and the various components we will cover. This may look familiar because we talked about it during our first meeting last month.

If you have some time before we meet, you may prepare a list of usernames and passwords for your financial accounts. I set aside time for us to work through this together during our meeting if you get stuck.

Please remember to bring your financial documents to our meeting so we can get them scanned and stored securely in your RightCapital Vault.

I am looking forward to seeing you soon,

Emily

Emily Purdon, CFP®, EA

Financial Planning & Process Coach

Fee Structures & Implementation

A process timeline can apply to a variety of fee structures. What does each client experience when they first talk with you and subsequently, through a defined period of time?

Capture your process in an infographic to facilitate your conversations. This will help you illustrate any work the client(s) may be unaware of going into your process for the first time.

Here are some examples of common fee structures and billing arrangements for a quick reference:

A one-time financial plan with a defined scope (i.e., a project).

- Billing: 100% upfront or 50% upfront/ 50% at plan delivery

- Example: $2,500 upfront/ $2,500 at delivery

An upfront, comprehensive financial plan followed by an ongoing retainer fee.

- Billing: 100% upfront or 50% upfront/ 50% plan delivery, then a retainer fee

- Example: $1,500 (Month 1)/ $1,500 (Month 2), then $250/ month starting in Month 3

A retainer fee without an upfront financial plan fee.

- Billing: Monthly or quarterly

- Example: $300/ month or $1,000/ quarter

Assets Under Management (AUM) with or without an initial fee.

- Billing: Tiered or flat, quarterly

- Example: Flat 75 bps

Providing Value Beyond the Initial Plan

For those of you wondering what happens after your initial planning process, make sure to check out my blog entitled “Refining Your Client Service Model.”

A client service and communications calendar is essential when continuing to establish a consistent client experience. The calendar picks up after your initial timeline ends and sets the tone for the next 12 months.

About the Author

About the Author

After working as a financial planner at a large fee-only RIA in Northern Virginia, Emily joined XYPN’s Advisor Success team. As a CFP® professional and Enrolled Agent, Emily shares her financial planning knowledge and experience with members as they start, run and grow their businesses. She received her M.S. in Advanced Personal Financial Planning and a Financial Therapy Graduate Certificate from Kansas State University. Emily also completed Wharton’s Executive Education Program in Client Psychology and graduated from the FPA Residency Program.

Additionally, she serves as a Graduate Teaching Assistant for KSU’s financial planning program. She recently completed terms on the Financial Planning Association National Capital Area Board as the NexGen Director, and Virginia Tech’s Recent Alumni Board as the Outreach Chair.

Share this

- Advisor Blog (728)

- Financial Advisors (250)

- Growing an RIA (129)

- Business Development (101)

- Digital Marketing (97)

- Marketing (94)

- Community (82)

- Start an RIA (77)

- Coaching (76)

- Compliance (74)

- Running an RIA (72)

- Client Acquisition (68)

- Technology (67)

- Entrepreneurship (64)

- XYPN LIVE (64)

- Fee-only advisor (52)

- Sales (49)

- Bookkeeping (46)

- Client Engagement (45)

- Practice Management (44)

- Scaling an RIA (43)

- XYPN Books (43)

- Investment Management (41)

- Financial Education & Resources (37)

- Market Trends (32)

- Client Services (31)

- Employee Engagement (31)

- Lifestyle, Family, & Personal Finance (31)

- Journey Makers (26)

- Process (18)

- Niche (13)

- SEO (9)

- Career Change (8)

- Partnership (8)

- Sapphire (7)

- Transitioning Your Business (7)

- Emerald (4)

- Persona (4)

- Social Media (4)

- Transitioning To Fee-Only (4)

- Transitioning Clients (3)

- Onboarding (2)

- RIA (2)

- Transitioning to a Corporate RIA Affiliation (1)

Subscribe by email

You May Also Like

Our Top Blogs of 2020 for Independent Financial Advisors

Dec 31, 2020

9 min read

Spend Less and Get More with XYPN's Tech Stack

Oct 5, 2020

7 min read

.png?width=360&height=188&name=Copy%20of%20BLOG%20IMAGES%20TEMPLATE%20(21).png)