How to Create Personalized Investment Strategies Using Model Sleeves

Share this

Managing investments is easy…until it’s not.

It’s actually pretty simple to build an investment model. Heck, we give our models away for free at XYIS. It’s what you do with that model—how you sell it, package it, modify it, upload it, transition it, price it—that’s really important.

When most people hear the word “model,” they think bland, cookie cutter, and unpersonalized. And they push back because they want to give their clients a "personalized experience.” Well guess what? You can.

You can build investment portfolios that are both personalized for your clients and scalable for your firm.

So, where do you start?

Start with “Why?”

Take a page out of Simon Sinek’s book and start with why.

When contemplating your “why,” consider some of the following questions:

What am I actually trying to accomplish with my investment philosophy?

What’s my story? Is it a passive, cost-effective story?

Where do my expertise and competitive advantage lie?

Every good strategy has a story. At XYIS, our strategies each have a story and we have branded our portfolios appropriately. We have branded our strategies as CORE, CAUSE and CRAFT, each with a specific target and purpose in mind.

As we think about our target audience, there are two specific needs for many XYPN advisors and clients.

First, we have many advisors with emerging clients who are just getting started investing. Thus, there's a need for portfolios geared for small account balances and that are easy and cost effective to make ongoing contributions.

Enter our CORE NTF strategy, which is built on TD Ameritrade’s no transaction fee (NTF) platform and able to handle the smallest of account minimums. It also uses almost exclusively SPDRs ETFs, which makes expense ratios extremely low.

Secondly, many advisors and clients want their portfolios to have purpose. Not “a purpose” but purpose.

In this case, we created our CAUSE portfolios which are focused around ESG (Environmental, Social, Governance) and SRI (Socially Responsible Investing). While cost is a factor, the main driver here is “purpose.” The portfolio has a very specific purpose and “niche.”

Build for your Target Audience

Your portfolios should be built in specifically to the needs of your clients. The focus of the portfolio will change depending on your target client. Before even considering investment philosophy factors, be sure to address the basic nuts and bolts first:

- Investment experience and acumen of target client

- Average account size

- Accounts per client

- Asset location

- Amount of ongoing contributions/distributions

- Tax considerations

- Cost considerations

- What types (if any) of in-kind assets might transfer in

- Typical client goal: accumulation, income, protection – or – first home, college, monthly paycheck

And we haven’t even touched on active versus passive yet!

(And we won’t. That's another conversation for another time.)

“Personalize” Don’t “Customize” using Model Sleeves

We have a target client and we have a good story…now what?

I hear way too many advisors talk about customization. I understand that some people use this as a selling point, but we live in a different world now.

You don’t get to design your own shoes at Nike ID—you get to personalize an existing model. You aren’t designing your own Tesla—you’re creating your own personalized Model S with the options available.

We can do the same with investment models. And we can do it with relative ease using what are known as “sleeves.”

A model sleeve is a singular piece of a portfolio with like attributes. The most basic types of sleeve distinction are equity fixed income sleeves. We also commonly see “other” and “satellite" sleeves.

“Other” sleeves includes things like real assets, for example real estate, commodities or “stuff.”

"Satellite" sleeves are for those who utilize a “Core and Satellite” or “Core and Explore” type strategy. This is where there might be some slight active management or where “fat pitch” type investment might come into play.

Here’s how it works: Instead of building a model portfolio, construct an equity allocation and a fixed income allocation. Everything will be built off of these.

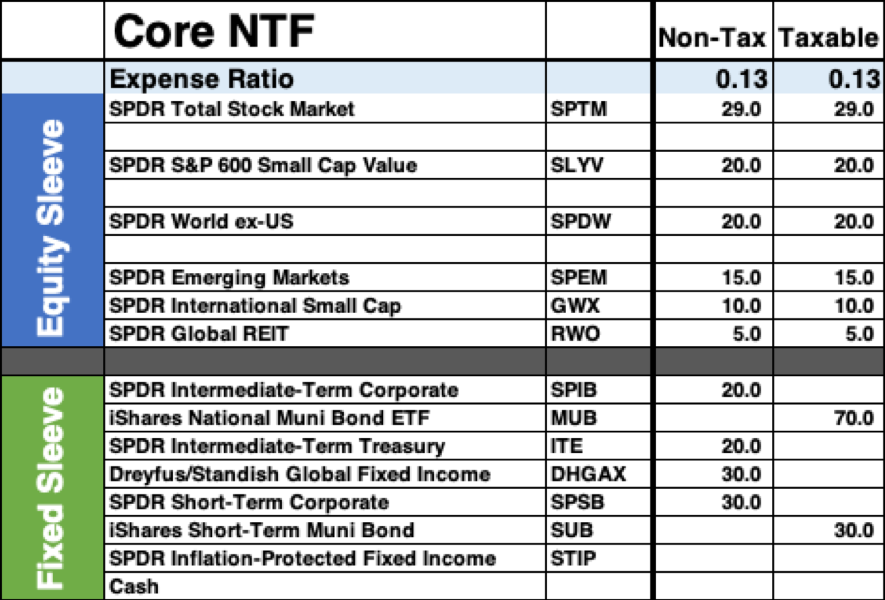

This is what the XYIS CORE NTF Equity and Fixed Sleeves look like:

Essentially, we can build any model allocation we want or need with those two components.

Notice we also have a taxable and non-tax option. The point is we don’t have a ton of models—we have two and can build whatever we need off of those two.

We also have allocation models without the actual investments (ETFs/MFs) slotted in. This allows us to have multiple sleeves for various purposes. Thus, our allocation sleeve is the same for all our portfolios, but the investments in our CORE NTF strategy are different than those in our CAUSE (ESG/SRI) strategy.

How Personalization Works

Taking a look at the models above, what would you change?

Let’s assume we have a client who has rental properties. Perhaps they don’t need additional REIT exposure. We simply ZERO out the REIT and the 5% allocation gets distributed to the rest of the equity pieces in the appropriate allocation.

What about the client who has large stock option holdings in a company like Amazon or Exxon? After a conversation with the client (that is documented for compliance purposes), you might determine to simply limit equity exposure across the board. Or, you may determine your client should be part of the large cap/total market positioning and adjust accordingly.

Again, nothing has changed in the models. We’ve simply made slight tweaks to the allocation.

Instead of having to monitor multiple client models, we simply need to monitor an equity model, a fixed model, and a very limited number of ETFs/funds.

It’s THAT Simple…Until We Start Being Humans Again

That all looks and sounds easy, but there’s much more to it. Our human behavior is probably the biggest complicating factor. You will want to change and do more “stuff.” You will question yourself. You will question your allocations. A client might want to apply that new ETF you only just read about…..

STOP.

Don’t do it.

Have discipline.

Execute.

This is of course easier said than done.

But remember, what you can do with 20 clients is not what you’ll be able to do with 40, 60, or 80. With each differentiating factor you create, consider the amount of time and effort it will add to your process.

A Few Other Tips and FAQs

TIP: Limit the number of holdings

It’s easy when you’re growing to “accumulate” holdings over time. Consider this scenario: Client brought over fund A because the taxes were high; another client wanted to hold Fund B, and there's this reason we're holding Fund C that I don’t recall right now. And this goes on and on and on. Before long, you’re holding over 200 different securities. If you’re managing and billing on those, you need to have a compliance and due diligence process for them as well. It gets unnecessarily complicated very quickly.

TIP: Use Sub Funds

A sub fund is a substitute for another of your funds. The best and sometimes one of the only good examples is in your large cap allocation. If one client is holding SPY but your model calls for VOO, you can use SPY as a sub for VOO. Most rebalancing engines can accommodate for this. This isn’t always a good idea, however, particularly when you get out of index funds and also as you get into more esoteric allocations.

TIP: Know your platform—be custodian agnostic

If you use multiple custodians, be sure you set up models with funds that are available on both platforms. It can be tempting to use the index funds at Schwab and the SPDRs at TD. Just know that you are now responsible for double the number of holdings.

TIP: Use your allocation model for 401(k) assets

What about those clients who come in with 401(k)s and need an allocation? Use your same allocation model and find the index equivalents. If the plan does not have an index or ETF option, you’ll have to kick it old school style.

What about capital gains taxes on transferred assets? When should we pay the taxes versus going into “the model”?

While it’s not black and white, there are some considerations.

First, have conviction in strategy. Your model was built and designed for a specific reason and purpose.

Second, be sure you evaluate what you are bringing in and what you are managing. You will be managing whatever assets transfer in and you will be responsible for their respective experience with those assets.

When calculating the taxes, evaluate the cost versus the benefit. If it’s allocation-related, we almost always suggest paying the taxes to get the portfolio to the appropriate allocation. Even slight market movements can justify the tax in very short periods of time, particularly with individual or concentrated positions.

When it’s an ETF and even another index ETF, you must have a solid understanding of what this specific ETF is doing and holding. ETFs are notorious for naming themselves according to what they’re trying to do, not necessarily what they hold. Thus, you could have a “fixed income fund” holding derivatives to mimic the fixed index they are following.

Lastly, if you want a quick calculation method, take the cost of the taxes to be paid and divide that by the total of the portfolio. This will give you the basis point equivalent of the “cost” of the taxes.

Example:

$350,000 account value

$70,000 long term capital gains

$10,500 taxes due (15% rate)

$10,500 / $350,000 = .03 or 3%

In this example, any change to the portfolio should net a 3% enhancement, by either increased return or downside protection. In either case, 3% is not a difficult number to make up, particularly if a client is in a more aggressive or less diversified portfolio.

What about trading and trade costs?

For the cost factor, you can run the same calculation as above, just with trade costs. The difference being, this would be on both taxable and tax deferred/free accounts and usually only for accounts on the smaller side.

Also, consider the platform. If you are transferring assets, it can sometimes be advantageous to have them sold at the previous custodian. There are two main reasons for this: one might be cost, but the other is for tax and cost basis reasons. All the reporting will be there.

In Closing…

Investments can be easy(ish) if you stick to your models the same way you expect your clients to stick to their financial plans.

Although easier said than done, it’s very possible. Don’t let the temptation to take the easy route ruin long-term success. Be diligent with your model sleeves and stick to them.

About the Author

About the Author

A creative innovator and collaborator, Brandon Moss has had a front-row seat to the digital advice revolution, helping build one of the most innovative national RIAs on the planet. He’s acquired a 360* view of the RIA landscape, from being an advisor and running his own firm to designing and integrating some of the most innovative tools in the industry. He has lead, trained, coached, onboarded, integrated, transitioned, (you name it) over 100 RIA firms/wealth management teams. Additionally, he's evaluated, prospected, pitched (again...you name it) countless other firms. Consequently, he's an exceptional listener and comfortable in many different conversations! Occasionally, he's asked to opine on varying topics, typically Gen X+Y, innovation, client experience and technology. Beyond those topics, he's typically “winging it”. Brandon graduated from Texas Tech University's globally recognized personal financial planning program, then made it through some Executive Education at UC Berkeley's Haas School of Business. He’s also perpetually in online classes trying to figure out something new. Brandon resides in the Dallas/Ft. Worth area with his wife, Shelby, and his identical, mirror-image twin boys, Will and Reese. When he's not with them, he's probably in his garage tinkering, building, or buying way too much golf equipment.

Brandon is the Director of XY Investment Solutions (XYIS), XY Planning Network’s digital hybrid investment platform. It’s a turnkey asset management platform (TAMP) designed and curated to the specific needs of XYPN members.

This information is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, XY Investment Solutions, LLC (referred to as "XYIS") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. XYIS does not warrant that the information will be free from error. None of the information provided is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall XYIS be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if XYIS or an XYIS authorized representative has been advised of the possibility of such damages. In no event shall XY Investment Solutions, LLC have any liability to you for damages, losses and causes of action for this information. This information should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.

Share this

- Advisor Blog (726)

- Financial Advisors (248)

- Growing an RIA (129)

- Business Development (100)

- Digital Marketing (97)

- Marketing (94)

- Community (82)

- Coaching (76)

- Start an RIA (76)

- Compliance (72)

- Running an RIA (72)

- Client Acquisition (68)

- Technology (67)

- Entrepreneurship (64)

- XYPN LIVE (64)

- Fee-only advisor (50)

- Sales (49)

- Bookkeeping (46)

- Client Engagement (45)

- Practice Management (44)

- Scaling an RIA (43)

- XYPN Books (43)

- Investment Management (41)

- Financial Education & Resources (35)

- Client Services (31)

- Employee Engagement (31)

- Lifestyle, Family, & Personal Finance (31)

- Market Trends (30)

- Journey Makers (26)

- Process (18)

- Niche (13)

- SEO (9)

- Career Change (8)

- Partnership (8)

- Sapphire (7)

- Transitioning Your Business (7)

- Persona (4)

- Social Media (4)

- Transitioning To Fee-Only (4)

- Emerald (3)

- Transitioning Clients (3)

- Onboarding (2)

- RIA (2)

- Transitioning to a Corporate RIA Affiliation (1)

Subscribe by email

You May Also Like

These Related Stories

How Financial Advisors Can Give Better Advice with Dr. Moira Somers

Feb 4, 2019

3 min read

Your 2025 Year-End RIA Checklist: The 5 Reviews Every Firm Should Do Before January

Dec 8, 2025

3 min read