3 Tools You Can Use to Turbocharge Your RIA’s Marketing Funnel

Share this

If you’re thinking about diving into marketing automation for your RIA, or building out a marketing funnel for your financial planning firm, you’re in the right place. Part of a robust marketing funnel is a tech stack that does 3 things:

-

Gives you time back in the day

-

Automates important touchpoints with your leads

-

Doesn’t cost more than it’s worth.

Points 1 & 2 are no-brainers, but #3 can be a bit of a head-scratcher. If you’re evaluating marketing tools for your business, then I’m here to de-mystify the process. Here is a list of platforms with pros, cons, and some personal recommendations.

3 Tools You Can Use to Turbocharge Your RIA’s Marketing Funnel

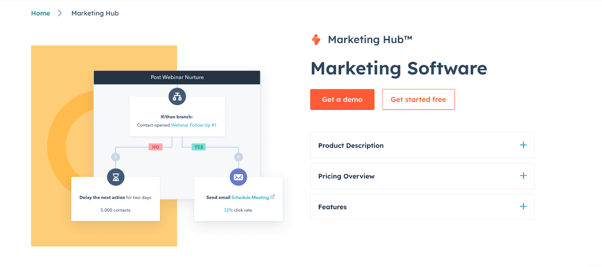

HubSpot Marketing Hub

G2 Crowd rating: 4.4 out of 5 stars

Cost: Free, with restrictions ($18/month starter recommended)

Recommended firm size: Any

Customer support: Fantastic

Ease of use: Beginner/intermediate

HubSpot is my weapon of choice as a marketer. I’ve used this platform in so many ways, and it’s made my life easy in thousands more. They’re constantly innovating and finding better ways to do things. It’s no secret around the XYPN office that I’m a bit of a HubSpot nerd and cheerleader. I actually wasn’t going to rank them as #1 originally, but when researching for this article I found that they aren’t as cost-prohibitive for the average RIA as they used to be. So here we are. I’ll try and keep this as unbiased as possible, for your firm’s sake.

Recommended tier - Starter - $18/mo

Pros:

-

Lead nurturing and forms are very intuitive. You can build out touchpoint journeys for your leads that are easy to visualize and understand.

-

The interface is clean, well laid-out, and easy to navigate

-

The training and support is second-to-none

-

The community forums are full of solutions to even the most complex problems

-

Lifecycle qualification is automated and easy to set up

-

Embeddable forms, landing page tools

-

Blogging tools included

-

CTAs and A/B testing

-

The reporting is second-to-none

Cons:

-

Once you hit 1,000 users you’re capped. You’ll need to constantly scrub your database of unengaged contacts to make sure you don’t hit this cap.

-

Cost-prohibitive growth. The next tier-up is $800/month. If you want to use it as a simple lead generation and nurture tool, HubSpot will do right by you. If you’re planning financial planning firm’s growth and digital expansion, make sure you can afford to grow with Hubspot. It gets expensive to transition off.

Advisor I/O

G2 Crowd rating: N/A

Cost: $74.99/month ($60/month if you’re an XYPN member)

Recommended firm size: Small

Customer support: Great

Ease of use: Beginner

Advisor I/O is an XYPN tech partner - if you’re one of our members, you can get this for $60/month! I’m a big fan of the fact that they’re advisor-oriented and make it easy to stand up your marketing funnel right away. If you’re looking for a way to turn on the “leads machine” then Advisor I/O is a great place to start. Having never used Advisor I/O myself, I felt it necessary to dive deep into their content to make sure this recommendation was as comprehensive as possible.

Pros:

-

Out-of-the-box email campaigns are a great way to get your lead nurture off the ground. Where other marketing platforms leave it to you to decide, Advisor I/O knows the kind of touchpoints you need right away.

-

Their library of support articles makes it easy to learn and educate yourself quickly.

The article-sharing functionality readily lends itself to client-advisor communication. -

You can build out libraries of articles for easy access too.

Cons:

-

If you’re not an XYPN member, it can be an expensive add-on for your tech stack. For the $74.99/month per user, you're not getting some of the other tools that more traditional marketing automation platforms can lend to your inbound strategy.

XYPN membership is about community, independence, and tech stack savings. If you’re interested in Advisor I/O, check out some of the other tech and benefits you can get access to. There’s probably some software in there that you’re already using, so the savings can be immediate.

Mailchimp

G2 Crowd rating: 4.4 out of 5 stars

Cost: Free, with restrictions ($20/month recommended)

Recommended firm size: Any

Customer support: Decent

Ease of use: Intermediate

Mailchimp is a standard marketing automation platform (MAP) that can simplify how you collect, nurture, and convert leads into customers. While you can get a free version of it, I’d recommend spending the $20/month so you can use some of the more advanced features. You’ll also be allowed more contacts, and you won’t have tacky Mailchimp branding on your emails, forms, and pages.

Pros:

-

The most inexpensive option for the number of features you get. This is a cost-effective option for small firms, and you won’t grow out of it. Your firm’s ROI will be higher, and faster with Mailchimp.

-

Extensive forums and support - they have so many users, that you can count on the fact that someone else has already tried to do exactly what you’re looking for help on.

-

You can A/B test - testing is the only way to know if your marketing is really working, and pivot quickly! Ask anyone at XYPN - I TEST EVERYTHING

-

Embeddable forms - embed these on your pages to gate your consideration stage content

-

Automated customer journeys allow you to nurture contacts in the consideration stage

-

This is kind of both pro and con, but the reporting is valuable for business owners. As a marketer and data nerd, the reporting leaves ME wanting more.

-

Customizable email templates allow you to brand your emails and pull in contact information. For example, you can say “Hi , in the subject line to be more personal. More personal=higher open/click rates.

Cons:

-

Really the only con, and it’s a big one for me, is that MailChimp is hard to learn. Every time I use it, I have to re-learn how to create templates, where my audiences are, how tagging works, etc. I’ve been in marketing automation for almost ten years and I can say that MailChimp is the least intuitive I’ve used, which is ironic because they’re owned by Intuit.

-

The reporting leaves me wanting more (as a marketer and data nerd)

There are SO many MAPs out there that I haven’t been able to get my hands on that are probably wonderful. On that same coin, there are tons that I would NEVER recommend. At XYPN, we’re big fans of Inbound Marketing principles, and I can say that all three of the above platforms can help you build your own Inbound marketing plan with relative ease. I hope you’ve found this honest and helpful, and if you have anything you want to discuss, feel free to reach out to me on LinkedIn or in our XYPN VIP Facebook Community. I love a good marketing chat.

About Sam McCue

Sam McCue is XYPN's Director of Sales & Marketing Operations. He specializes in all things SEO, marketing strategy, and automation.

Share this

- Advisor Blog (727)

- Financial Advisors (249)

- Growing an RIA (129)

- Business Development (101)

- Digital Marketing (97)

- Marketing (94)

- Community (82)

- Start an RIA (77)

- Coaching (76)

- Compliance (73)

- Running an RIA (72)

- Client Acquisition (68)

- Technology (67)

- Entrepreneurship (64)

- XYPN LIVE (64)

- Fee-only advisor (51)

- Sales (49)

- Bookkeeping (46)

- Client Engagement (45)

- Practice Management (44)

- Scaling an RIA (43)

- XYPN Books (43)

- Investment Management (41)

- Financial Education & Resources (36)

- Client Services (31)

- Employee Engagement (31)

- Lifestyle, Family, & Personal Finance (31)

- Market Trends (31)

- Journey Makers (26)

- Process (18)

- Niche (13)

- SEO (9)

- Career Change (8)

- Partnership (8)

- Sapphire (7)

- Transitioning Your Business (7)

- Emerald (4)

- Persona (4)

- Social Media (4)

- Transitioning To Fee-Only (4)

- Transitioning Clients (3)

- Onboarding (2)

- RIA (2)

- Transitioning to a Corporate RIA Affiliation (1)

Subscribe by email

You May Also Like

These Related Stories

.png?width=360&height=188&name=Own%20Your%20Niche%20Inbound%20Marketing%20for%20RIA%20Owners%20(1).png)

Own Your Niche: Inbound Marketing for RIA Owners

May 1, 2023

8 min read

XYPN Roundup: How to Market Your Financial Planning Firm

Jun 8, 2020

12 min read