The Essential Guide to RIA Registration

Learn what to expect when registering your Registered Investment Advisor (RIA) firm from XYPN Compliance—a leader in RIA registrations and compliance consulting.

This guide is your first step toward wearing your Chief Compliance Officer cape with confidence. Together we’ll demystify the process and equip you with everything you need to know about initial registration of your RIA.

You’re in the right place if you plan to register your RIA at the state level in your primary jurisdiction (the state where your principal place of business is located).

You’re also in the right place if you reasonably expect to have $100M or more in regulatory AUM within 120 days of becoming registered, in which case you’ll likely qualify to register with the SEC* rather than at the state level.

*The process of preparing and submitting the application is almost the same for both; however, the SEC generally doesn’t require additional documents beyond Form ADV, Form CRS, and Form U4 submission through the Finra Gateway. We will touch on the other differences later in this guide.

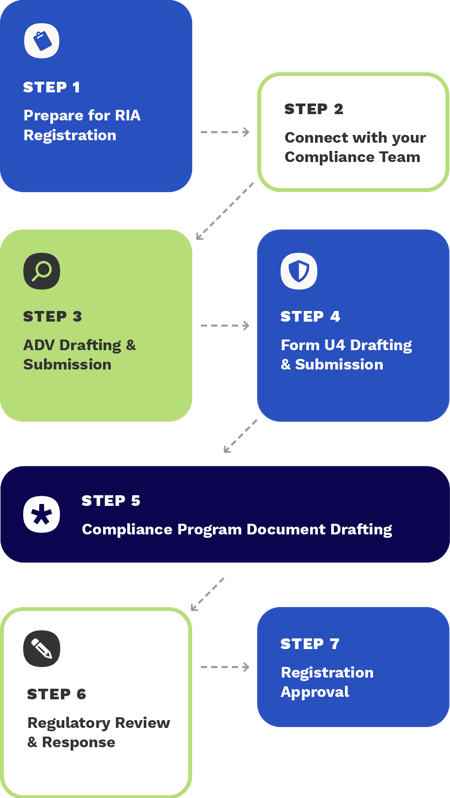

7 Step RIA Registration Process

With XYPN Compliance

XYPN Compliance was a critical resource during the initial registration process. From the templates to the open office hours, they were there every step of the way. The Compliance team had a thorough understanding not just of the paperwork that was needed, but the timeline and work-style personalities of the regulators in many states to be able to communicate expectations during the approval process. The templates and resources were extremely helpful in expediting registration and increased my confidence in my compliance program and the initial registration process. XYPN Compliance is an invaluable resource and I would highly recommend them.

Worried about going it alone? Don’t be. XYPN Compliance offers solutions to help you every single step of the way!

Prepare for RIA Registration

With XYPN Compliance this step is as easy as:

-

→

Attend a Preparing to Register Call the compliance solutions team holds weekly for an overview of the process

-

→

Fill out their short and simple RIA Registration Questionnaire that will become the foundation for the application forms they draft and submit for you

-

→

Establish your FINRA Gateway

The FINRA Gateway is the regulatory filing and reporting portal used to administer your registrations and filings for your firm and all supervised persons.

Start by setting up a Super Account Administrator, which can be done by filling out the New Organization SAA Entitlement Form.

Easy, right?

Once established, you may need to set up specific entitlements for your user access. If so, follow these instructions.

Within the Finra Gateway, you will have access to both the Central Registration Depository (CRD) and the Investment Adviser Registration Depository (IARD) system.

The CRD System is your primary dashboard when logged in and is where you administer the registration and filing information for any IAR of your firm.

The IARD System is where your firm’s Form ADV is filed, including filing for your firm’s registration with any jurisdiction.

Want this ultimate guide at your fingertips? Download it now:

Connect with your Compliance Team

Here’s when the good stuff begins. We’ve been told that connecting with the Compliance team is often the highlight of this whole process. Their friendly expertise and depth of knowledge of the regulatory intricacies for each State jurisdiction has put hundreds and hundreds of new firm owners’ minds at ease.

During this step you will get introduced to a member of the Compliance team who will guide you through the following:

-

→

Review and select the Compliance plan that fits you best

-

→

Sign an engagement agreement

-

→

Determine your location-based registration fees (applicable to the state jurisdiction where your firm will register and offer its services)

-

→

Receive instructions for funding your FINRA “E-Bill” Account and creating limited access for your Compliance team to submit your application and forms on your behalf

NOTE: E-Bill is FINRA’s financial system that enables users to view and fund all the accounting details of FINRA Flex-Funding and Renewal Accounts, pay annual renewal assessments, and view and pay FINRA invoices.

It is crucial to pay these fees and ensure they are available in your E-Bill account before the Form ADV can be submitted to initiate your firm’s registration.

Pro Tip:

Curious what your registration fees will be in your jurisdiction?

Google “Investment Advisor Registration in [Your State]” and locate the search result for your securities division website.

If you are registering with the SEC, you can review the initial and annual filing fees here.

ADV Drafting & Submission

After you’ve fully funded your E-Bill Account and provided the Compliance team their FINRA Gateway access information, they will start your application process by drafting your ADV.

What’s that you ask? Well, as stated in the Kitces.com blog, Form ADV Part 1: Common Missteps And Best Practices For RIAs:

“Form ADV is perhaps the most important document a registered investment adviser will prepare in the entirety of its life cycle—at least from a regulatory perspective. This is not only because it is filed with the SEC and/or state securities regulatory authorities, but also because it is publicly available and ostensibly relied upon by prospective clients when evaluating whether or not to entrust their life savings with a particular adviser.”

Form ADV

From the same blog, Form ADV is: “A standardized description of each RIA’s services, fees, and business practices, presented in a series of four forms (Part 1, Part 2A, Part 2B, and Part 3).”

Your form ADV (specifically Part 2A) is referred to as your firm’s disclosure brochure or simply your “firm brochure.” During the preparation of your registration application, drafting of this brochure is critical as it will be the primary focus of review by state regulators (or the SEC) when they evaluate your application.

We often encounter advisers just starting out who get stuck on what to include in their firm brochure, as they don’t want to be “locked in” to something knowing that their firm will evolve after launching. We remind them that this disclosure brochure is never intended to be set in stone once it’s filed and should be viewed as more of a living document that is maintained and revised as the firm’s business practices evolve.

For purposes of getting registered, focus on the services, compensation, and practices that you know you will be prepared to engage in upon launching or within the first year of operations. You will quickly learn how to make updates to these documents when necessary once you get your firm off the ground. And we can help with those updates too, btw.

-

ADV Part 1 (no a.k.a for you, Part 1)

Part 1 requires information about the investment adviser’s business, ownership, clients, employees, business practices, affiliations, and any disciplinary events of the adviser or its employees.

-

ADV Part 2A (a.k.a. the “Brochure” and, if applicable, “Wrap Fee Program Brochure” or just “Part 2A Appendix 1”)

Part 2A requires a written narrative brochure with information about your firm’s services, fees, conflicts, and personnel. The instructions require 18 disclosure items (19 for state-registered firms), which must be included in the brochure.

-

ADV Part 2B (a.k.a the “Brochure Supplement”)

Part 2B contains required information about the individuals providing financial advice at your firm. It should be consistent with Form U4 in all material respects.

-

ADV Part 3 (a.k.a. Form CRS or “Relationship Summary”)

In short, Form CRS—short for customer relationship summary—is a written disclosure you must provide to clients to share key information about your background and practices.Form CRS* is a brief relationship summary containing plain English disclosures on specific topics designed to help retail investors make informed choices when deciding which advisory firm they want to work with based on alignment of their goals and objectives.

Once you review, approve and give permission for your Compliance Teammate to submit your ADV, filing triggers notification of pending application—AND THE REVIEW PROCESS BEGINS. (Yay!)

That’s right. Kick back and relax for this step.

Your Compliance team will draft your Form ADV and send it to you for review. Once approved, they’ll also submit it with your permission.

NOTE: Form CRS currently only applies to investment advisers registering with the SEC and state-registered advisers in Rhode Island.

Form U4 Drafting & Submission

Another “kick back and let your RIA compliance solutions team draft for your review” step, this one acts as a sort of a background check. You’ll need one Form U4 for each advisor (IAR) within your firm.

FINRA uses Form U4 (Uniform Application for Securities Industry Registration or Transfer) to elicit employment history and other information.

Compliance Program Document Drafting

Advisory client agreements

Most jurisdictions require written agreements to be in place for every advisory client. Those agreements, in addition to other required contract provisions, must include:

-

+

Description of services to be provided

-

+

Term of the contract

-

+

Applicable planning and/or advisory fee

-

+

Formula for computing the fee if it is anything other than a flat/fixed fee

-

+

Amount of any prepaid fee (if applicable) to be returned in the event of termination

-

+

Any grant of discretionary trading authority to the investment adviser

-

→

Draft Client Agreements for your review

-

→

Provide templates and a list of documents required by the state for RIA registration

-

→

Review and approve Client Agreements

-

→

Compile the list of documents requested and tailor templates to be submitted to the state

This will formulate your written policies and procedure manual. All investment advisers must establish, maintain, and enforce written policies and procedures tailored to the investment adviser’s business model, taking into account the size of the firm, type(s) of services provided, and the number of locations of the investment adviser firm.

The policies and procedures must be reasonably designed to prevent violations by the investment adviser and its supervised persons of the Advisers Act of 1940 (for SEC-Registered Firms) or similar state statutes, rules, and regulations (for State-Registered Firms).

“Our initial RIA registration was complex since we work in multiple states and our primary state is one of the most thorough before they will approve registration. XYPN Compliance was an amazing partner through this grueling process. They responded immediately to all the requests from States, patiently walked us through amending any documents, and provided us with many resources to calm us as frustration built.”

Don’t worry! We’ll provide you templates for advisory client agreements.

Regulatory Review & Response

Filing of Form ADV, as well as Form U4 for each IAR of the firm, takes place within the FINRA Gateway on the IARDTM and CRD system of the FINRA Gateway. And yes, you guessed it, your Compliance consultant will file on your behalf so you can focus on fun stuff like your Marketing Funnel!

-

→

This process can vary significantly from state to state. In general, now is when the regulators will correspond with you to address any questions or ask for specific changes based on their interpretation of your disclosure documents and the adequacy of any additional documents submitted.

-

→

For SEC registrations, the SEC will typically only reach out to you if they have questions or concerns regarding the responses to your ADV Part 1 questions, if there was an incomplete or inaccurate ADV filing, or if there are arrangements or disciplinary disclosures that warrant additional questioning.

Once completed, additional required documents (as discussed above) are typically sent directly to the state securities division by email—or in some cases, even in today’s modern world, by regular mail.

When all information has been received by the state or the SEC, it moves into a queue for review by an examiner.

Don't Backburner Compliance!

We have seen several advisors 1-2 years in that have put compliance on the back burner and need help getting caught up.

You can avoid this situation by focusing on getting your processes and systems in place before the rest of your business begins to ramp up.

An easy way to do this is to build a Compliance Calendar. Check out this Kitces.com blog for a great how-to: Crafting An Annual Compliance Calendar For A (Solo) RIA: Staying On Top Of Compliance Tasks While Serving Clients.

You’ll find that “Once compliance tasks are systematized into time blocks on a calendar basis–approximately 1 hour for monthly tasks, 4 hours for quarterly tasks, and 8 hours for annual tasks, at least for a solo advisor—it’s feasible for the RIA to keep their compliance house in order with barely 2% of their annual working hours...leaving the other 98% of their time to serve their clients effectively (and get new ones, too)!”

-

→

Send a document request letter or email to you if any additional documents are needed.

-

→

Forward all state communications to your Compliance Teammate

-

→

Provide feedback to resolve the state’s comment letter

-

→

Receive and respond to the state’s comment letter

-

→

Repeat cycle as needed until they see your approval notice and send you the good news!

During this time, your state or the SEC will generally review your application and respond with any questions, required changes, or areas needing additional clarification.

Learn more about compliance package options with XYPN Compliance →

Pro Tip:

Heads up! If you’re transitioning from a Broker-dealer, RIA, or insurance company, your employer has 30 days to file a Form U5 (termination) for you following your resignation. In states that don’t allow dual registration, or with a firm that is not supportive of allowing you to be dual-registered as part of the transition, a compliance officer that is slow to terminate an IAR could create an additional unanticipated delay.

Pro Tip:

While you wait, turn to the FUN part of your business and plan for its future by completing the First Year Business Plan (if you haven’t already!)

Registration Approval

The SEC generally approves most investment adviser applications within 45 days if all information was submitted correctly and they do not have any concerns with the filing.

Unfortunately, registering at the state level is not always so straightforward. Depending on your state, it typically takes 6–12 weeks for the state to approve your application once filed.

FORTUNATELY, you have a partner monitoring the status of your application for you. It’s always fun to see who notifies you first: your Compliance consultant or your registrar through FINRA.

“At XYPN, we’ve seen many registrations vary on either side of this range, so please note, some states may take longer than others due to their review processes, staffing issues, the volume of applications under review, or in some cases it may be concerned with certain business models that require substantial back and forth.”

Once your firm becomes registered, we always say this is when the real fun begins! You are now set up for launch and free to market to your niche, onboard new clients and start serving them on your terms!

As a new business owner though, you will have much to do and look forward to so pause and take some time to celebrate this fundamental accomplishment in your firm’s beginning. Whatever your celebration jam is, take a moment to enjoy this milestone in your journey!

Have questions? Connect with an XYPN Success Strategist today!

Want to take this content on the go? Download the PDF version!

Pro Tip:

The key to simplifying and streamlining compliance management is to stay a step ahead so you can spend less time reviewing your firm’s policies and procedures annually. Find out how: Mastering Your Compliance Program as an RIA Owner

From Our Blog

Stay up to date with what is new in our industry, learn more about the upcoming products and events.

KPIs for Fee-Only RIAs: What to Track and Why It Matters

SEC Proposes Updating the Definition of “Small Entity” for RIAs

.png)