These Related Stories

10 Steps for Choosing the Best Business Path for Scaling Your Firm

Share this

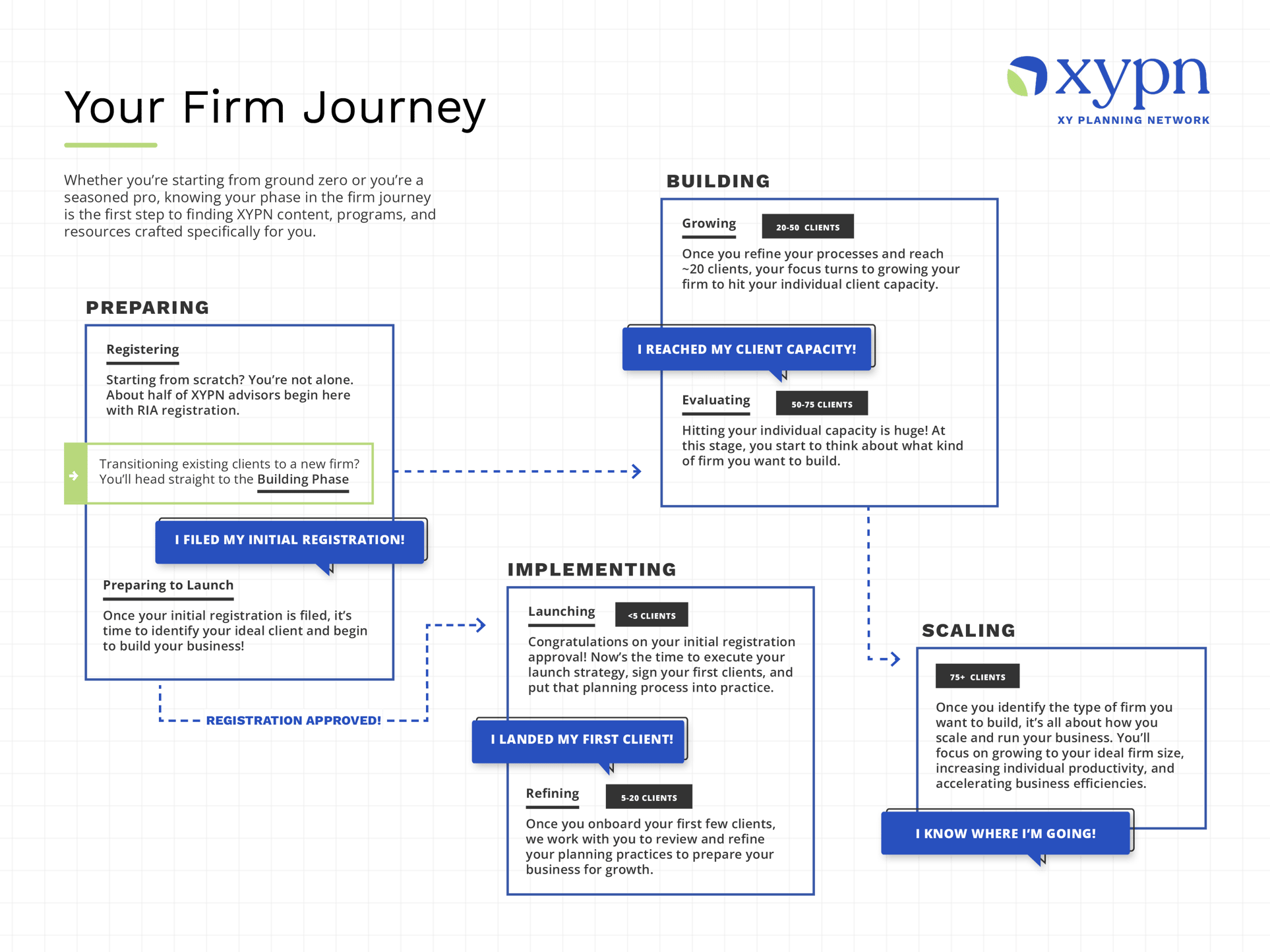

Once you’ve reached max capacity to serve your clients within your practice, you’re ultimately faced with the decision of which business path will work best for you and for your firm. While you undoubtedly started your firm with a specific path and future in mind, the hands-on experience you’ve gained as an advisory firm owner is likely to further guide you in making this decision, or even change the course of your business altogether.

At XYPN, we’ve developed a number of educational resources and programs designed to help you navigate this critical milestone. The aptly named "Scaling Phase" is when you'll determine the best way to scale your firm depending on your personal goals and your goals for your firm.

You’re ready to enter the Scaling Phase when you’ve reached your individual capacity as a planner and have identified the type of firm you want to build.

Our goal is to help you make an informed decision based on several factors, including considerations related to:

- Staffing

- Firm profitability

- Client experience and client service

- Time constraints, and of course

- Your interests and skills as a planner and as a business owner

There are three business types that most scaling firms are building: a solo practice, a boutique firm, or an enterprise business.

- The solo practice firm owner wants to be the lead planner with clients and focus on scaling their personal productivity and client experience. Generally, they will cap the number of clients based on their individual capacity.

- The boutique firm owner acts as the lead planner for some clients but is also focused on running the business. This firm will grow thoughtfully and add staff and planners as needed.

- The enterprise firm owner is focused on running the business and will hire planners to work with the clients. The goal of this firm is to scale clients and revenue quickly.

When entering the scaling phase, you’ll be ready to make strategic business decisions while continuing to refine your sales, marketing, and business processes based on your firm’s growth and specific goals.

In this post, I outline 10 steps you can take to determine what kind of practice will be best for you long-term. I’ve also included several questionnaires taken from the SEI white paper, The Purposeful Advisory Firm: Maximize Your Firm by Design, Not by Default, based on the results of a March 2017 survey of advisory firms; these questionnaires can help you further develop your conception of your ideal firm.

Part 1: Who You Are as a Business Owner and What Do You Want Your Firm to Look Like?

Step 1: Consider what you want your personal future to look like

Through your experience as both a planner and a business owner, you probably already know whether you’d like to focus more on client relationships or on firm growth, people management, hiring, etc.

This is the time to be honest with yourself about what you know will be sustainable for you over time.

Would continued one-on-one work with clients ultimately cause burnout for you and cause you to feel stagnant? Or, on the flip side, if you were to go the enterprise route, would the pressures involved with this model feel overwhelming and unsustainable? For some firm owners, the prospect of continued growth along with building and managing a team is exciting. For others, working directly with clients is the most meaningful—and rewarding—part of being a planner.

If your ultimate goal is to go the enterprise route, but you’re concerned you’ll miss out on building client relationships, think about whether this desire may be fulfilled through managing and building relationships with the planners and other staff you hire. Enterprise firm ownership can definitely be a relationship focused undertaking, so keep this in mind as you weigh your options.

Step 2: Revisit your WHY

Now’s the time to revisit why you chose to start your own advisory firm and consider whether your thoughts about this have changed based on your experience as a firm owner. A purposeful exploration of this question will involve:

- A thorough examination of what really drives you, i.e., what’s at the heart of why you want to either serve clients and how you want to do it (as Simon Sinek describes, your core “purpose, cause, or belief”).

- Revisiting your stated core values, mission, and vision to determine whether they still fit your firm now and whether they will in the long-term.

Step 3: What’s your ideal primary role?

Eventually, you’ll have to decide whether you are a financial planner first or a business owner first. According to the research conducted in the study mentioned above, The Purposeful Advisory Firm:

“Most respondents (64%) view themselves as advisors who also happen to be business owners—not business owners who are advisors. While it may seem nuanced, the advisor-first view manifests itself in ways that may limit future opportunity. More than a quarter of these advisors (26%) report they have no intention of building the next generation. Many maybe unrealistic about translating their firm’s hypothetical value into a retirement plan or a legacy for their heirs. Absent a plan, many of these firms will perish with their owners.”

While there’s no right or wrong choice here, the message is clear: the first step is to be intentional about your choice and the implications of that decision.

Step 4: Consider Your Legacy

This is a critical consideration for deciding what type of business you want to build. If legacy is important to you, then the enterprise model may be the right choice for you. If you’re not too concerned about your business living on exactly as you’ve designed it after you’ve retired from the industry, then a solo or boutique practice could be more appropriate. Just be sure, no matter what path you choose, to develop a solid succession plan for your firm, even if you’re not fixated on exactly how the business will be run once you’re no longer involved.

Step 5: Consider Short- and Long-Term Revenue Goals

As mentioned above, the goal of the enterprise model is to scale clients and revenue quickly. Keep in mind, though, that this model can result in a cycle of staffing costs offsetting new client revenue. As Michael Kitces mentions in his September 2019 blog post, The Capacity Crossroads and The Small Giant Alternative To Building A Lifestyle Or Enterprise Firm:

“The problem...is that even for those who choose the path of continued growth, once an advisor crosses that capacity threshold, not only are any additional clients less profitable (due to the higher overhead costs incurred by increasing staff), but the advisor also has to manage that growing number of team members… which is rarely a goal for advisors who decided to strike out on their own to serve clients (and not manage employees)!”

As this post outlines, there is actually “little evidence to suggest that there are any economies of scale growing down the road from being a ‘small’ solo practice to a multi-billion-dollar firm.” So, while you do want to consider overall firm financial goals, don’t sacrifice client relationships or lifestyle just to grow for the sake of growing.

Part 2: Creating a “Purposeful Advisory Firm with a Strategic Plan”

In this section, I’d like to highlight some considerations for various aspects of your business: people, value proposition/brand, your firm’s financial planning and investment philosophy, and your technology.

These questions were presented in the white paper mentioned above, The Purposeful Advisory Firm, and will help you assess which aspects of your business are essential to your ideal firm and how you can adapt to provide the best possible service to your clients. The overall goal is, to reiterate, to be intentional about these factors, rather than reactionary.

Step 6: Consider the Value of People

These questions are designed to help you think about staffing, training, culture, process, and compensation within your firm:

- Do you have the right staff in the right jobs to maintain your current business?

- What aspirations do you have for taking your firm to the next level?

- Do you have the appetite for adding (and managing) more employees?

- What roles will they play?

- What training and development resources are you committed to providing?

- Do you have the right processes in place to keep your staff’s morale high?

- What strategies do you have in place to develop next-generation talent and acquire

- next-generation clients?

- Can you define your firm’s culture, and does everyone fit well within that culture?

- Do you have a compensation model in place to keep the people you want to keep?

- Does your staff have the right process and workflows in place for your business model?

Step 7: Consider Your Value Proposition/Brand

These questions go back to your “why,” the deep-rooted reasons behind your firm’s mission, vision, and values. Use them to better articulate your value proposition and define your brand:

- Does your value proposition truly differentiate your business from your competitors? How?

- If you decide to expand your reach, how will your value proposition change?

- What new services are you considering adding to retain existing clients and attract new ones?

- Have you ever asked your existing clients how your value proposition matches up with their view of your firm?

- Many owners choose simply to brand their personal identity; that decision could dramatically restrict their ability to sustain a valuable enterprise in the future. If you are the brand, how will your firm endure without you?

- Is your brand clear? Does it match your value proposition? Are your current clients’ needs and characteristics consistent with the who, what and why stated in your value proposition?

- Have you segmented your clients by what is important to them—and not you? Do you offer different services to the different segments?

Step 8: Consider Your Financial Planning/Investment Philosophy

What services you offer—and how you offer them—are key parts of your business model. These questions will help you refine your service model and articulate your offerings to clients in a way that resonates with your target market:

- What financial planning tasks do you do well and enjoy most? Conversely, what do you least enjoy and do poorly?

- Is your firm differentiated by factors outside of your control, e.g., the markets and the economy?

- Can you fire yourself?

- What services do your clients value? How do you know?

- If you are an enterprise firm and bring in a CIO, are you changing the focus of your services?

- Are you being compensated for your advice—are you charging enough for your services to cover your costs? How do you know?

- How do you want your clients to see you?

- What is the risk of diminishing your value to clients when delegating certain investment management tasks? How do you know?

- Are there ways to streamline your processes?

- What do your clients value most from your services? How do you know?

- At what AUM level is your firm capacity constrained?

Step 9: Consider the Value of Technology

Technology should be specifically selected based on the type of firm you are building and the client services you offer. Use these questions as a starting point to ensure that you are using technology that helps you provide optimal service and enables you to scale appropriately:

- Is your firm getting the most utility from your current technology platform?

- Have you assessed your firm’s technology needs within the past 12 months?

- What are your biggest obstacles with your current technology platform?

- Are your systems integrated? Do you use workflows?

- How will new technology purchases/outsourcing improve your client experience?

- How will new technology purchases/outsourcing improve your firm’s overall efficiency?

- Will the new technology solutions you’re considering disrupt your business? How?

Step 10: Be intentional

I have previously mentioned the importance of carefully calculating all the factors involved in your ultimate decision regarding which type of firm will work best for you. It’s important to point out that, on the flip side, a lack of strategy can have major negative consequences for not only you as the firm owner, but for your staff and your clients as well.

The risks of not having a well-thought-out plan are very real and can result in inefficiencies within your firm, “emergency” hiring, lack of well-defined services, client confusion, and wasted resources.

So, if you’ve reached, or are close to reaching, firm capacity, know that you are on the brink of an exciting decision that can have a tremendous impact on your firm’s future. If you put in the time to consider all of the factors outlined above and make decisions based on the kind of business you know you’ll love running, you’ll be well-positioned to enjoy continued success no matter which firm type you choose.

About the Author

About the Author

Kate Ross has spent the last ten years of her career developing educational materials for financial professionals and brings a passion for instructional design and curriculum development to the XYPN team.

In her free time, Kate can be found front row at a concert, camping in the woods, floating a river, or hiking in the mountains near her home in Montana.

Share this

- Advisor Blog (727)

- Financial Advisors (249)

- Growing an RIA (129)

- Business Development (101)

- Digital Marketing (97)

- Marketing (94)

- Community (82)

- Start an RIA (77)

- Coaching (76)

- Compliance (73)

- Running an RIA (72)

- Client Acquisition (68)

- Technology (67)

- Entrepreneurship (64)

- XYPN LIVE (64)

- Fee-only advisor (51)

- Sales (49)

- Bookkeeping (46)

- Client Engagement (45)

- Practice Management (44)

- Scaling an RIA (43)

- XYPN Books (43)

- Investment Management (41)

- Financial Education & Resources (36)

- Client Services (31)

- Employee Engagement (31)

- Lifestyle, Family, & Personal Finance (31)

- Market Trends (31)

- Journey Makers (26)

- Process (18)

- Niche (13)

- SEO (9)

- Career Change (8)

- Partnership (8)

- Sapphire (7)

- Transitioning Your Business (7)

- Emerald (4)

- Persona (4)

- Social Media (4)

- Transitioning To Fee-Only (4)

- Transitioning Clients (3)

- Onboarding (2)

- RIA (2)

- Transitioning to a Corporate RIA Affiliation (1)

Subscribe by email

You May Also Like

Thinking About Scaling Your Firm? These Podcasts Will Help

Jan 27, 2020

9 min read

Laying the Foundation for Your Brand

Mar 10, 2025

4 min read