Investment Management: Communicating Your Value as a Financial Advisor

Share this

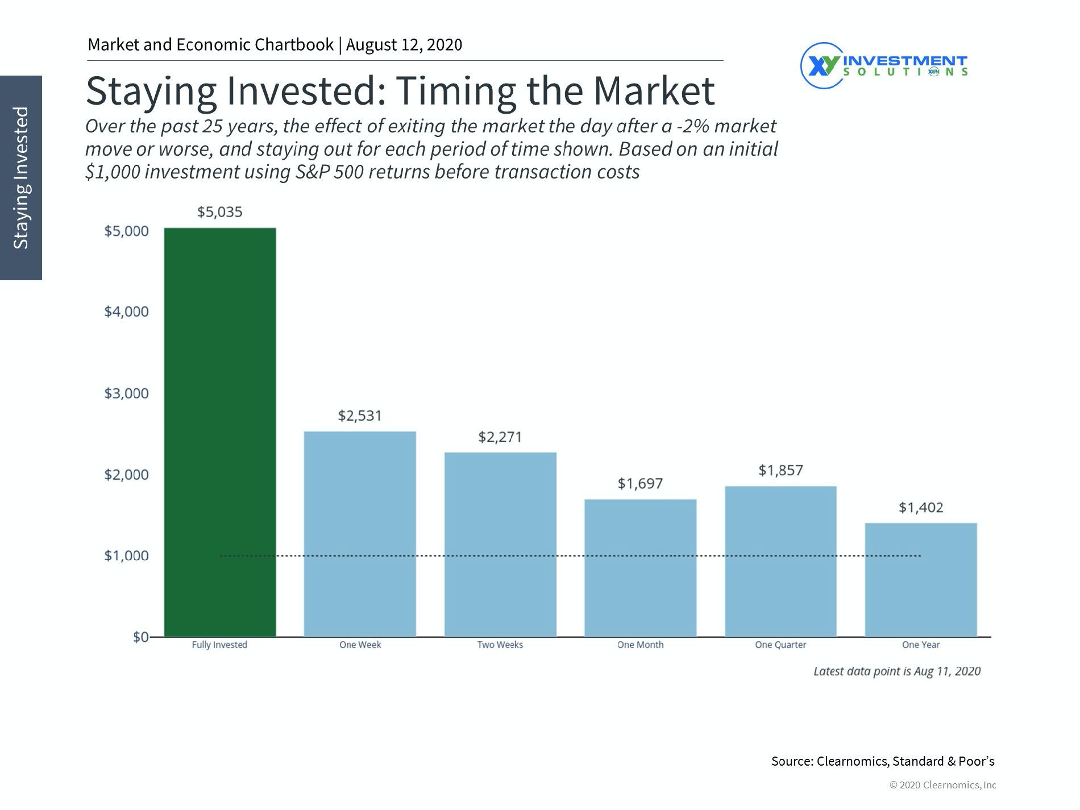

As the steward of your client’s financial plan and investment strategy, one of your biggest value propositions is managing their expectations and mitigating any behaviors that might take them off track. Consider the chart below as an example of this potential value. It illustrates the impact of missed time being fully invested because of a reaction to a negative move in the market. Over the course of 25 years, exiting the market for just one week, or 0.08% of the total time period, following a negative move results in a financial outcome that is roughly half of the outcome from staying fully invested.

Imagine witnessing your client, who is managing investments on their own, reacting unfavorably to a decline in the market and experiencing an outcome towards the right of this chart. Then consider what conversations you can have with them to keep them on the left side of this chart, fully invested. That represents a huge value proposition you can offer as their financial advisor.

Now that we see how valuable an advisor can be in implementing an investment strategy and managing investors’ behaviors, the next step is determining how to do it.

Setting Expectations Early in the Relationship

First, it’s critical to set expectations at the beginning of the relationship. We already know that at the time of your first meeting with a prospective investor, they most likely haven’t fully differentiated your financial planning services from your investment management services. It will be important to reinforce this concept throughout the conversation by stating what the purpose of the investment strategy is—to move your client from their current financial situation to a stated financial goal in the future. The long-term return expectations you seek should depend on this purpose only. It’s easy for investors to get caught up in the competitive nature of investments and to want the highest returns possible. You must work with them to temper these instincts and instill long-term discipline to help ground them with their financial goals. This is also a good opportunity to discuss risk. [More on that another time.

Regarding long-term return expectations, another hurdle to overcome is that investors in general have much loftier expectations than what advisors think is realistic. The 2020 Global Survey of Financial Professionals showed that individual investors in the US had annual return expectations of 10.9% above inflation while financial professionals surveyed responded with 6.7%. This results in an 62% expectations gap. While the expectations gap itself is important for advisors to note, it’s also quite interesting to consider that this survey was conducted in March and April of 2020, right in the middle of markets reacting to the economic shockwaves of the COVID-19 pandemic. Even though the longest bull market in history ended on March 11, 2020, investors and financial professionals alike were as optimistic as they were a year ago (individual investors’ expectations were 10.9% and financial professionals’ expectations were 6.3%).

Why does this specifically represent a challenge to promoting good investor habits? Without having realistic expectations for long-term returns, investors may be less likely heed the advice of their advisor who is basing their recommendations on lower expectations. They may also have a more extreme reaction when directly confronted with results that don’t match their expectations, leading them to seek safety by pulling out of the market or trying a new strategy.

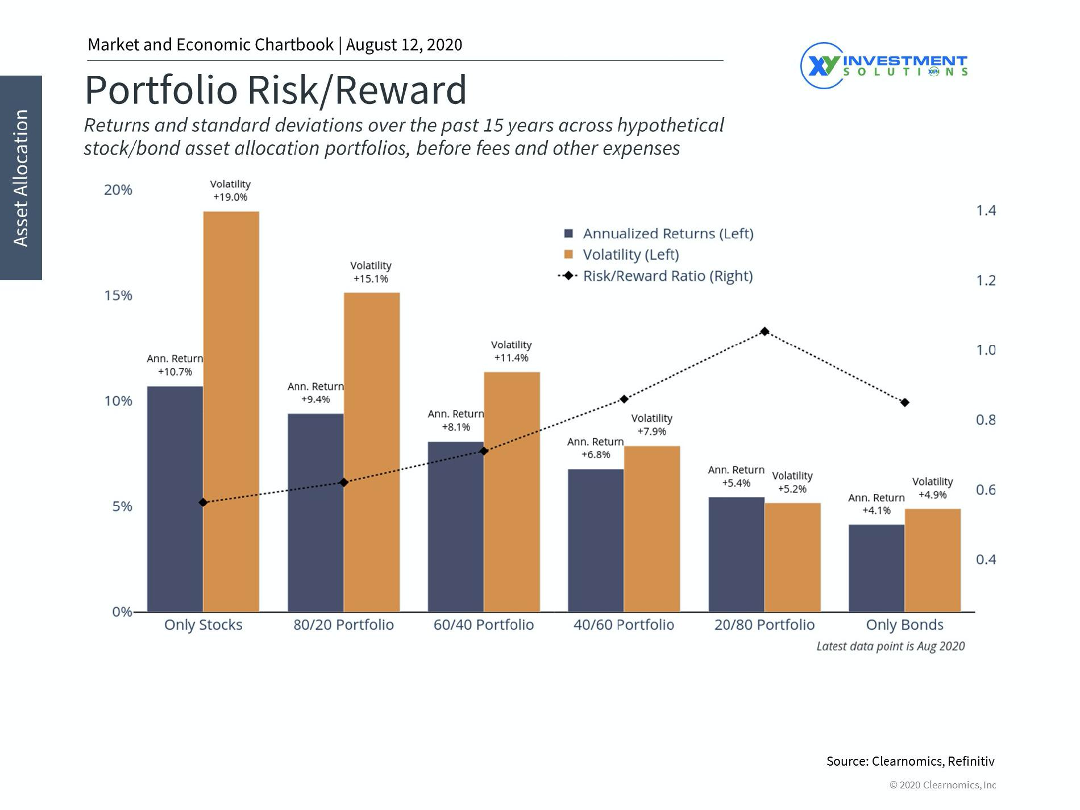

Reminders about the purpose of their investment strategy and setting up realistic return expectations early on will be the backbone of an investment management process that adds a lot of value for your clients. The chart below is a great example of how you can not only set up some realistic return expectations, but also share the risk associated with different return levels. The volatilities noted for each strategy are a good way to start the discussion about how “bumpy the ride” will feel and you can start preparing them early on for those situations when they might feel tempted to flee to safety.

Adapting the Strategy Beyond Asset Allocation

Beyond the asset allocation determination, there are additional factors that can be adapted to the individual investor. As mentioned before, there are many good investment strategies but picking the one that best matches with the investor’s personal situation will increase the likelihood of them sticking to the plan during turbulent times and the probability of success. Here are some of those factors:

- Portfolio size. With adoption of commission-free ETF and stock trades and fractional shares, adapting strategies for portfolio size is not as much of a challenge in terms of market entry for investors. Before this, it used to be cost prohibitive for an investor to participate in the market through a diversified portfolio because of high ticket charges. Imagine an investor wanting to get started in the market with $10,000 and working with an advisor whose simplest model had five positions with a $10 ticket charge for each. For the initial investment, that would amount to 50 bps in fees taken out right at the start. Depending on how frequently you rebalance the whole portfolio, you’d take an additional 50 bps each time. These are significant expenses that an advisor would have to manage. Though ticket charges aren’t as much of a concern now for smaller accounts, there still is a time cost to managing many securities—due diligence on each security and rebalancing all of the positions—that both advisors and investors managing on their own need to be cognizant of.

- Tax sensitivity. Remember the investing adage, “It’s not what you make, but what you keep”? Monitoring ways to reduce an investor’s tax bill is an important part of the value you add as an advisor. One consideration is which investment vehicles to use. Turnover within a fund results in capital gains distributions, which usually hit the investor towards the end of the calendar year. The higher the turnover, the higher the capital gains. Advisors can prepare for this by either avoiding funds with high turnover, employing other tax minimization strategies throughout the year, or using ETFs, which, by the nature of their structure for managing investment inflows and outflows, generate fewer capital gains distributions. Another strategy to consider for investors in higher federal tax brackets and states with higher taxes is the substitution of municipal bonds for taxable bonds. The interest on “munis” is not taxed and investors can avoid taxes on all or a portion of the interest they earn from these bonds. One caveat here is that the determination of effectiveness of munis is dependent on the investor’s tax rate. Tax-equivalent yield is the formula used to determine this effectiveness for each investor.

- Values-based factors. Investing is emotional—“emotional” does not always have to be synonymous with “lower returns.” Consider socially responsible investing. According to the US SIF, SRI investing has been on a steep growth trajectory since 2012 and as of 2018, accounted for over a quarter of all professionally managed assets. The growth in demand for investment strategies that allow investors to have a measurable impact in their world beyond financial returns provides a unique opportunity for advisors to diversify an investor’s motivators. We can apply the same principles of diversification of portfolio risk to an investor’s behaviors. Diversifying away the impact of one motivator—earning higher returns—on financial success can again reduce some of the knee-jerk reactions investors tend to exhibit when short-term market volatility picks up.

- Active versus passive. This is where I employ the “pick your battles” mentality when it comes to helping investors adopt an investment strategy. We know that the debate over whether active or passive management outperform in the long-run will be forever ongoing so the point here is to have a transparent discussion about the merits of each philosophy and determine which is the path of least resistance, again remembering that if the investor is not likely to change their mind based on what’s currently trending positive, they will have a greater likelihood of success.

Creating a Schedule of Consistent Communication

Finally, another action you can add to your arsenal of investment management value is steering your client’s investment behavior by creating habits of consistent communication about investment and market-related topics. With the countless ways that investors are receiving news, there are many opportunities for them to receive bad advice and/or to be confused about what’s relevant to their financial goals; the objective here is to assert yourself as your client’s single source of investment truth or investment thinking partner.

By creating a schedule of communications tailored to your clients (or client segments if you serve a wide range of clients), you have a greater chance of keeping them focused on your investment messages rather than the latest news headlines. Consistency in this instance is reflected in the cadence, how you’re communicating, and about what. Here’s a simple example to start setting up that communication:

|

Communication Types |

||||||||

|

Scheduled |

Event-Driven |

Client-Specific |

||||||

|

Quarterly |

Email Newsletter |

Market Commentary & Investment Updates |

One-off |

|

Unexpected fiscal or economic policy change |

Annual |

Plan Review |

Market Contributors & Detractors to Financial Outcomes |

|

One-off |

Email with video message |

Market drops 5% in one session / Heightened market volatility |

One-off |

Plan Review |

Unexpected life event |

|||

As an advisor, you have a long window of opportunity to continuously add value to your client’s plan through the investment management process, mainly by promoting healthy investing habits that keep them focused on their stated financial goals. By setting expectations early on, adapting investment strategies to their personal situations, and creating a consistent schedule of communication, you’ve the laid the foundation to effectively communicate your investment management value with clients and prospects alike.

About the Author

As the Managing Director of XYPN Invest, Lisa leads the charge in communicating and continuously improving upon the value of XYIS’s services to XYPN members. She has a diverse background spanning over a decade in the financial services industry. Prior to joining XYIS, Lisa served as operations and technology leader for Clearnomics, a SaaS company for financial advisors, and for Fragasso Financial Advisors in Pittsburgh, PA.

This information is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, XY Investment Solutions, LLC (referred to as "XYIS") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. XYIS does not warrant that the information will be free from error. None of the information provided is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall XYIS be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if XYIS or an XYIS authorized representative has been advised of the possibility of such damages. In no event shall XY Investment Solutions, LLC have any liability to you for damages, losses and causes of action for this information. This information should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.

Share this

- Advisor Blog (727)

- Financial Advisors (249)

- Growing an RIA (129)

- Business Development (101)

- Digital Marketing (97)

- Marketing (94)

- Community (82)

- Start an RIA (77)

- Coaching (76)

- Compliance (73)

- Running an RIA (72)

- Client Acquisition (68)

- Technology (67)

- Entrepreneurship (64)

- XYPN LIVE (64)

- Fee-only advisor (51)

- Sales (49)

- Bookkeeping (46)

- Client Engagement (45)

- Practice Management (44)

- Scaling an RIA (43)

- XYPN Books (43)

- Investment Management (41)

- Financial Education & Resources (36)

- Client Services (31)

- Employee Engagement (31)

- Lifestyle, Family, & Personal Finance (31)

- Market Trends (31)

- Journey Makers (26)

- Process (18)

- Niche (13)

- SEO (9)

- Career Change (8)

- Partnership (8)

- Sapphire (7)

- Transitioning Your Business (7)

- Emerald (4)

- Persona (4)

- Social Media (4)

- Transitioning To Fee-Only (4)

- Transitioning Clients (3)

- Onboarding (2)

- RIA (2)

- Transitioning to a Corporate RIA Affiliation (1)

Subscribe by email

You May Also Like

These Related Stories

How to Get the Most Out of Your Investor Policy Statement (IPS)

Feb 24, 2020

9 min read

Navigating the World of Values-Aligned Investing

April 22, 2019

5 min read

.png?width=360&height=188&name=BLOG%20IMAGES%20TEMPLATE%20(60).png)