How to Master the Art of Prospecting: A Step-by-Step Guide for Financial Advisors

Share this

After working closely with your compliance gurus, you’ve submitted your ADV and finally launched your firm. The first iteration of your website is up and running. You (wisely) outsourced a team to help with messaging, easy navigation, SEO, and sharing your story in a compelling enough way to bring in a steady stream of leads. Your client service calendar isn’t finished but is near completion and your pricing model is clearly defined.

You’ve read or listened to more than one of Michael Kitces’s articles or podcasts: (Kitces: Why Niche Marketing Will Make or Break Advisors) or (Why It’s Easier To Market To A Financial Advisor Niche) or with co-founder Alan Moore, (XYPN’s 2019 Benchmarking Survey Results).

Despite the all-too-common feeling that you’re ‘narrowing the playing field’ by choosing a niche (you aren't!), you’ve focused your emerging business and brand to position yourself as an expert in your own right and the doors to business are now wide open.

Now what? Might this sound like you?

“Alright, where to focus? I don’t have anyone sending me leads as they did in my former firm. It’s just me now…‘chief cook and bottle washer’ and dang I’m not entirely sure what I should be doing. I guess I should network to find sales leads, but where?

Or maybe I’ll start calling some friends I know to ask for referrals or maybe I could engage a few of Uncle Jack’s sons. My wife Mary’s co-workers are probably good prospects. Maybe I could speak at one of the ‘Lunch n’ Learns’ they have on Wednesdays? What do I say when I meet someone?”

You look in the mirror, put on your best business face:

“Hi, I’m Todd Reynolds. I’m a financial planner with a new firm I founded called Reynolds Financial Services. I’m a fee-only, fiduciary financial planner and I help people plan for their future, manage debt or assets, plan for taxes, and avoid challenges. I help my clients work past challenges and work toward your goals.

I went to school at Virginia Tech and am a CFP® and a CFA and have my MBA. In addition to my planning services, I manage AUM though it’s not necessary to have assets to work with me as my key focus is the financial planning work I do with doctors and people in healthcare. My wife is a doctor so I’m aware of the challenges and pitfalls people in that professional field face. I help similar professionals manage their student loan debt and also navigate employee benefit packages.”

SCREEEEEEEECH goes the needle on your record player, the whistle on the train, the kettle on your stove…..STOP!

(Once more for good measure)

STOP!

Rewind please. Let’s return to Todd’s thinking bubble where he smartly stated, ‘Where do I focus?” Good question. Where do you begin with your prospecting efforts, when to comes to business development for financial advisors?

In this blog, I will deconstruct—and thereby demystify—the financial advisor prospecting process, covering the following as we slice, dice, and mince the key tenets with our XYPN prospecting ‘best practices’ flow.

We’ll explore your:

1. Lead Development

2. Prospect Meeting Process

3. Discovery Meeting Process to Close

1. Lead Development

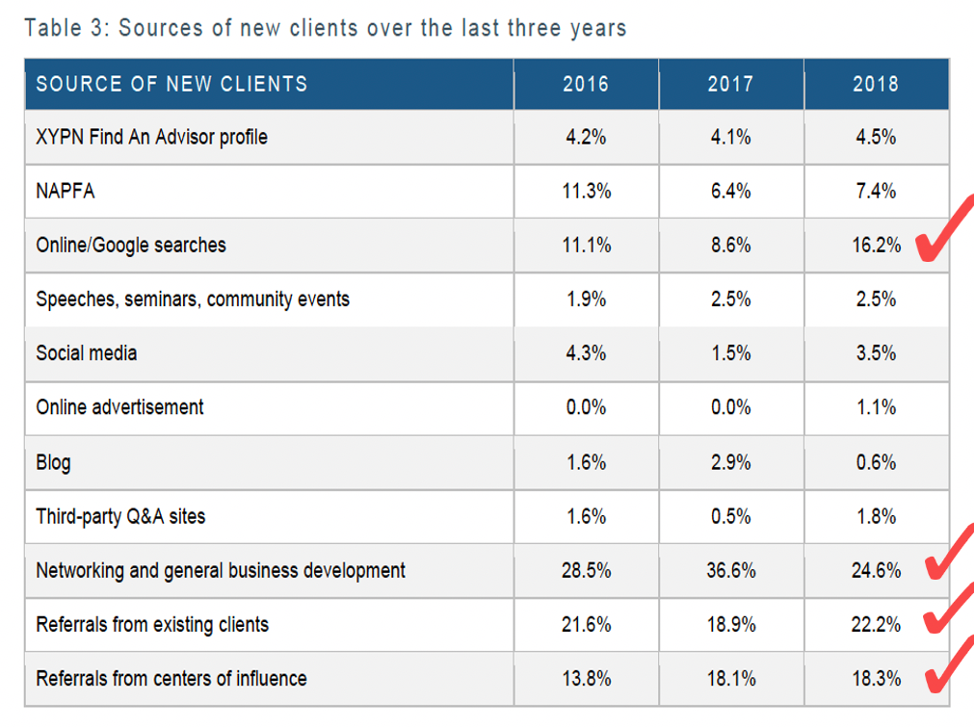

The start of any good sales process calls for marketing strategies that flush interested leads your way. You may engage in a variety of worthy activities and schedule them smartly in your monthly marketing calendar, though consider some of the results yielded by your peers. XYPN’s 2019 Benchmarking Study notes the following areas as marketing that created the greatest number of leads for its advisors.

With the highest lead generators being online google searches, networking, general business development, and referrals from existing client and centers of influence, you have a worthy guide for focusing your efforts. But what might effective networking and general business development look like?

With a defined niche, you have the opportunity to focus content creation, talks, and one-on-one dialogue with a target audience who is eager to learn from your expertise. In Todd’s case, his expertise is helping physicians and healthcare workers manage potential debt and navigate an often complex benefits world where they work.

You might ask next how to get in front of these people within your niche focus? Consider sharing your niche business focus on your website’s front page with a podcast highlighting your passion for your unique audience and excitement over the results you’ve helped people (like your viewers) wield. Share how you developed your passion:

- Your wife’s work as a physician and managing the debt accrued as she obtained her certifications

- The challenge you both experienced in navigating ever-changing benefits considerations

- Understanding complex tax implications

Make a list of the associations and places where your wife’s colleagues associate. Consider a talk you might give that is purely educational to the attendees yet shares your expertise and value as a financial advisor. How can you be of service to others through what you share? Be willing to both share your expertise and your own vulnerability when working past the pitfalls and challenges within you and your wife’s challenges with her debt and work benefits/ opportunities. Make your examples specific and your sharing in earnest and heartfelt.

Consider people to engage as centers of influence who might benefit from referring you. Might you and another high-quality firm share leads with prospects you each encounter who are ill-fitting for your firm’s focus, but who are the perfect fit for a colleague with a different niche or service offering? Consider mapping out a referral process by following these few steps:

1. Choose your Center of Influence and plan a time to meet one-on-one to share what you feel might be a win-win situation

2. Before meeting send a brief agenda highlighting your desire to:

a. Learn more about their business

b. Share about your business focus

i. Your passion and key service to your clients

c. Suggest how you might work together

i. Discuss where the value proposition is for each of you

ii. i.e. If you’re approaching an accountant, the value they might pass along to a client by referring you to assist them in better managing key challenges with their money (debt, savings, investments, tax implications for decisions made etc.)

d. Discuss your referral process

i. Plan a process for referral and communication throughout the process of engaging in your prospecting or if the prospect becomes a client

e. Discuss conducting periodic check-ins and updates

i. Assure your referral arrangement is a continued mutual fit and make adjustments as necessary

ii. Share gratitude or send a card or small gift as thank you for a winning referral

Add your key marketing events to a calendar and make sure to track which efforts produce which leads. If you have a CRM, use it to create custom reports to know which of your marketing efforts are yielding the greatest results.

2. Prospect Meeting Process

Key to remember with all your lead or prospect communications and engagements, through email, video conferencing, a talk you are giving, a blog you’ve written or an in-person meeting is to know clearly who you are speaking to and why you are delivering your message. Consistency in your messaging, your passion, and your key service areas should resonate along all communication platforms.

At XYPN, we suggest a two-step meeting process to engage and potentially close your client though certainly if you have a process that works better for you, do what works! This two-step process involves an ‘are we a fit’ meeting, which has a two-fold purpose: to see if you can solve a prospect’s pain points and help them achieve their goals with your expertise, and to create a no-pressure opportunity to gain trust, build rapport. and share how your service model might fit what your client is seeking.

Your 6-Step Prospect Meeting Overview

1. Getting to Know One Another

a. At the start of the meeting, thank your prospect for taking the time to meet to help you learn about their key desires and to explore how you might be able to help.

b. Share the intent of your meeting and explain that by the end of your time together, you’ll have a clearer idea of whether or not you’d like to move together to what you frame as a Discovery meeting.

c. Explain that a Discovery meeting is an opportunity to meet for an hour or more to take a deeper dive into key issues or goals presented by the prospect.

d. Let your prospect know that at the Discovery meeting, you will share some of your suggestions on how you would serve them in moving past challenges and working toward key goals.

e. Let them know that at the end of the Discovery meeting you can both decide if moving forward as a client makes sense.

f. Take time to find commonalities with your prospect—places you’ve lived, similarities in work experience, stories about your family—anything that will create a bond with your client.

g. Match behavioral styles with your prospect as best as you are able. Some people express through feelings, others in a very direct ‘let’s get it done’ manner. Do your best to consider how to listen to what is important to your prospect and match (where you can) vocal patterns such as speed, modulation, and body language.

2. Your Past Advisor Experience

a. Once you’ve developed a good connection with your prospect, ask them if they don’t mind sharing past experiences they’ve had with other advisors. Knowing where your prospect had possible challenging experiences with other advisors will give you an opportunity to frame how you share your key differentiators and value.

b. Keep in mind that anyone coming to you is possibly feeling vulnerable, is in a tough situation, and/or feels embarrassed for not seeking out financial advising help earlier. It’s not at all uncommon to work with people who are very accomplished in their own field but who lack the financial acumen you might expect. It is your job to meet them where they are and to help them feel comfortable and safe enough to be vulnerable with you. You might share areas where you too have struggled; perhaps your won struggles were a key initiator in getting certified to help other people in similar situations. Being authentic, transparent, and truly concerned for your prospect is key.

3. Your (Firm’s) Strengths and Passions

a. As you work to achieve conversational flow with your prospect, remember not to put them in the ‘hot seat’; rather work to share information back and forth. Share only what is relevant to them. There is no sense in spending five minutes sharing your savvy investment strategies if they have no assets for you to manage. Keep in mind too that if they are sitting with you or on a call, they have no doubt read about your certifications and where you went to school on your website or LinkedIn.

4. Why a Financial Advisor Now?

a. Ask your prospect what prompted them to this point. Listen carefully for what your prospect is sharing behind the words.

b. With the time you have allotted for your conversations, keep the focus on providing a high-level overview of your firm’s focus and your expertise as an advisor, and sharing brief stories on how you’ve helped solve issues for other clients who are similar to your prospects.

5. Firm Service Model and Advisor Investment in You

a. Once you have a better understanding of your prospect’s, goals, aspirations, and possibly key purpose for planning their finances (more on that in your Discovery meeting), accumulating wealth or moving past challenges to do so, you can share the aspects of your service model and service calendar that fits what your prospect desires. Keep in mind that sharing aspects of your offerings that aren’t relevant to them is not helpful at this point unless it’s framed as something to consider in the future to help with stated goals or their overall purpose for accumulating funds.

b. This is the time to share your pricing structure, be it project-based, subscription, or managing AUM. Share a story of when you helped another client reach their financial goals or overcome a financial challenge; this will help your client understand the return on their monetary investment (i.e. the fee they’ll pay you).

c. If your prospect has past experience working with a bigger firm, compare AUM fees and be sure to communicate the key differentiators in your model and the added value your planning services provide. More often than not I’ve seen pricing that is more than competitive with what the bigger firms charge yet with substantially more value per dollar with the addition of comprehensive planning services.

d. This is a good time to share a service model diagram if you have one, or to show how your service calendar works. Share stories of how you’ve addressed issues that clients didn’t even know they had but that were uncovered as you worked through your service calendar with them.

6. Potential Next Steps

a. Your job at this point is to make a recommendation to move forward with a deeper investigation of your prospect’s true purpose in wanting to manage their money more mindfully or to refer them to an advisor who is a better fit. If indeed they seem to be the right fit for you, you might frame potential next steps in this way:

“Jamie, I’ve really enjoyed getting to know you and greatly appreciate your time and willingness to share your situation and to consider what I can offer through my firm. As I shared, I have both a passion for and interest in the healthcare field and feel I am intimately aware of some of the challenges you are facing; they’re similar to what my wife experienced and what we navigated through not so long ago. I feel I can truly help you get to where you’re looking to go.

To understand at a deeper level how we might proceed, a next step would be what I call a Discovery meeting. During this meeting, we will take a deeper look at what concerns you have, what you’d like your money to accomplish for you and your famil,y and how we might work to get there.

I’m passionate about getting people where they want to go (and considering solutions that might make that happen sooner rather than later). I don’t see a reason why we might not make that next step. I’d like to send you a few questions to think about before we next meet and I’d like to also do some thinking around things we discussed together today. What are your thoughts?”

This is where you listen to any further concerns your prospect may have while doing your best to answer them and encourage a next step so you might investigate their situation a bit further, at no cost to your prospect.

Next, try always to get your next meeting on the calendar. You won’t be asking for account information but rather key questions to help better know their situation, which you’ll explore in the Discovery meeting. Thank your client for meeting and let them know you’ll be sending along some questions for them to ponder before you meet again. Express again your excitement for having met and for looking into their situation further.

Follow-up to Your Prospect Meeting

You’ve had a successful prospect meeting. Your client is willing to meet for a ‘deeper dive’ session where you’ll explore how to effectively manage their financial world and discuss life goals, aspirations, and purpose. Keeping your prospect engaged is key. I recommend using a workflow to manage your correspondence with your prospect (or client). A systematic process for follow-up assures you stay engaged with your prospect and remain ‘top-of-mind’ as you work to convert them to client.

As a next step, take a templated email you created and customize it to reflect what was discussed with your prospect.

- Thank them for their time and openness

- List (in bullets) the key areas you covered

- Share an attachment list of questions you want them to consider for your next meeting

- Share an article that highlights your areas of expertise that applies to their needs or something of personal interest to them to show that you were listening to what is important to them personally and/or with regard to finances

- Confirm your next meeting time and thank them again for taking time to meet with you

3. Discovery Meeting Process to Close

1. Share the purpose of your Discovery meeting

a. Welcome your prospect; if in person, offering a beverage is a bonus. Similar to your earlier prospect meeting, share the overall intent of your meeting: getting to know their situation, goals, and aspirations more thoroughly. Remind them of the agreed upon time frame and that the goal of the meeting is to ultimately determine whether you want to work together after sharing how you might address some of the issues and goals discussed.

2. Ask open-ended questions to learn more about prospect

a. There are many books written on the kind of open-ended questions that might be effective in a Discovery meeting. A good read is Alan Parisee and David Richman’s book on the topic, Questions Great Financial Advisors Ask. In their book, they quote Jonas Salk who asserted, “What we think of as the moment of discovery is really the discovery of the right question.’

b. Asking great questions, listening carefully, and rephrasing to affirm clarity, are all key at this stage as you work to uncover the key reasons this prospect wants and/or needs your help.

3. Discus key prospect topics/sharing high level solutions

a. As you begin to determine what is truly important to your prospect, you can begin to allude to how you might work with them to achieve that end, sharing more about how you work, strategies that have worked for others in similar situations and your passion to helping them get there.

4. Ask for their business

a. Once you’ve gathered sufficient information to know how you might start with your prospect, it’s time to begin your closing ‘ask.’ Restate what they shared, affirm the solutions you’d offer and highlight opportunities the prospect was unaware of. Be frank and let them know you’d be delighted to work together to help your prospect achieve their ideal financial future.

b. Ask if they feel comfortable moving forward and/or if they have any further questions.

5. Follow-up to your Discovery meeting

- Send a follow-up email with a review of key points and next steps

- Request key documents/financials to review

- Send the agreement to go over in-person or virtually

- Secure your prospect as a client!

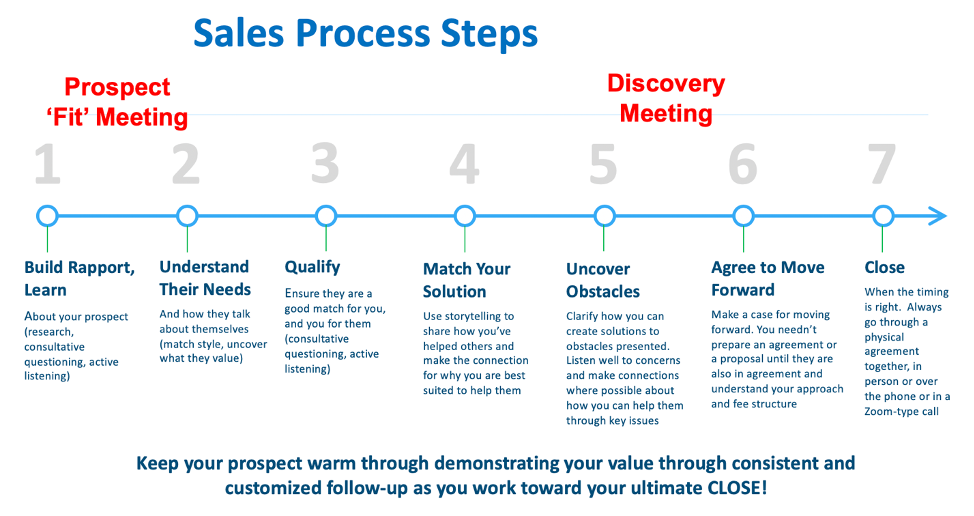

The graphic below outlines the seven steps of the sales process. There is both an art and science to this process. The science is the consistent framework from which to work; the art is the content and dialogue needed based on what you learn from your prospect. This part will become more natural with time and practice as you work to align the needs of your prospect with the value you provide.

Have fun with the process and forget perfect—it truly doesn’t exist.

.png?width=300&name=BB%20Webb%20(1).png) About BB Webb, XYPN Sales Coach

About BB Webb, XYPN Sales Coach

XYPN Sales Coach BB Webb has a background in both the arts and as an entrepreneur. She first learned about sales while touring her one-woman play across country and later through successfully growing her award-winning Atlanta based special event venue, selling it 14 years later to make a move to Bozeman, Montana.

As XYPN’s Sales Coach, BB’s primary goal is to assist XYPN members in building great relationships, plans and processes for selling their services as Financial Advisors. With a focus on consultative selling, BB’s programs and resources are developed to guide members in creating their own systems and conversations for selling their unique services, fearlessly and with joy.

Share this

- Advisor Blog (727)

- Financial Advisors (249)

- Growing an RIA (129)

- Business Development (101)

- Digital Marketing (97)

- Marketing (94)

- Community (82)

- Start an RIA (77)

- Coaching (76)

- Compliance (73)

- Running an RIA (72)

- Client Acquisition (68)

- Technology (67)

- Entrepreneurship (64)

- XYPN LIVE (64)

- Fee-only advisor (51)

- Sales (49)

- Bookkeeping (46)

- Client Engagement (45)

- Practice Management (44)

- Scaling an RIA (43)

- XYPN Books (43)

- Investment Management (41)

- Financial Education & Resources (36)

- Client Services (31)

- Employee Engagement (31)

- Lifestyle, Family, & Personal Finance (31)

- Market Trends (31)

- Journey Makers (26)

- Process (18)

- Niche (13)

- SEO (9)

- Career Change (8)

- Partnership (8)

- Sapphire (7)

- Transitioning Your Business (7)

- Emerald (4)

- Persona (4)

- Social Media (4)

- Transitioning To Fee-Only (4)

- Transitioning Clients (3)

- Onboarding (2)

- RIA (2)

- Transitioning to a Corporate RIA Affiliation (1)

Subscribe by email

You May Also Like

These Related Stories

.png?width=360&height=188&name=Copy%20of%20BLOG%20IMAGES%20TEMPLATE%20(13).png)

Create Connection and Close the Sale with These 3 Sales Process Truths

Aug 9, 2021

15 min read

Prospective Clients and that Initial Client Meeting: What Would Arlene Say?

Jul 13, 2017

5 min read