These Related Stories

8 Simple Tips to Optimize Tax Planning as an Advisor

Share this

Tax planning refers to the analysis of an individual's financial situation with the intent of receiving the maximum amount of tax breaks and minimizing their liabilities, which is another way of staying tax efficient. A tax plan should be an essential part of an individual's financial plan to analyze and prepare for present and future financial situations as the purpose of tax planning is to reduce the amount of tax liability and maximize the ability to actively contribute to retirement planning or other investments. Below are eight tips and techniques when it comes to tax planning and maximizing your tax planning experience.

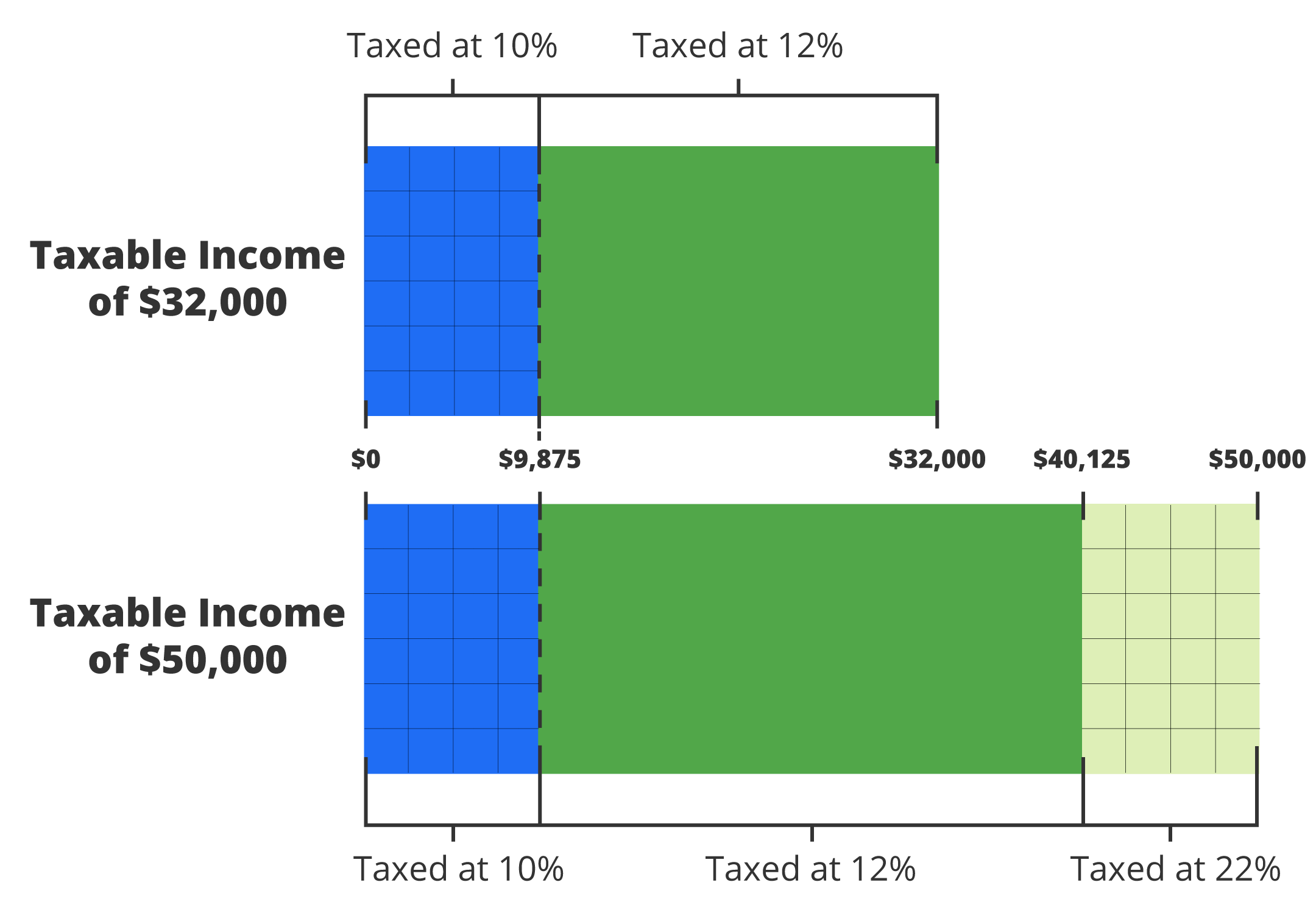

1. Tax Brackets

One of the best ways to prepare for tax season is to understand the tax bracket system and where your finances stand within these brackets. The United States uses a progressive tax system which means those with higher taxable incomes are subject to pay a higher tax rate and the opposite for those with lower incomes. There are seven federal income tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Many individuals hold misconceptions about how tax brackets affect the way their income is taxed. They believe if they jump to a higher tax bracket by only a single dollar, their whole income will be taxed based on the bracket they are currently in which can convince some people to reject certain job offers or raises. This misconception is absolutely not true. What actually happens is the exact amount of however many dollars is over the highest bracket threshold, will be taxed at that specific tax rate. So when it comes to making more money, go for it! Don't worry about the disadvantages of entering a new tax bracket.

2. Starting a Business

Along with receiving supplementary side income, a great way to receive additional tax advantages is starting and owning a business. Of course, some businesses do not evolve into the next Apple or Google but even a small business can receive great tax benefits to help them save and be able to use more money. Many expenses used for your daily operations can be deducted from your income, reducing total tax obligations. Also, by strictly following guidelines, a business owner could deduct some of their home expenses with the home office deduction. Necessary items such as a task, mobile drive, internet connection, and other specific utilities can be deducted which can save you a tax break along with generating a primary or secondary income.

Common self-employed tax deductions.

3. W4 Withholdings

The famous W4 form many people receive tells the employer how much taxes are withheld from each paycheck as the employer will send those taxed dollars to the IRS on the behalf of the individual. For tax planning purposes, the more allowances that are claimed, the less money will be taken out of each paycheck. To see more of your money appear on your check, claim fewer allowances on the W4 form. Here are some quick tips in regards to strategizing for tax planning:

- After receiving a high tax bill and do not want to experience paying another high tax bill, increasing your withholdings could help you owe much less for the next time you file taxes.

- After receiving a high refund check from the IRS, if you would like that money supplemented back into your consistent paycheck, you would want to reduce your withholdings.

- Most people think once you complete a W4 and start a job that it cannot be altered until after the filing year. At any point throughout the year, you may download a W4 form from the IRS website.

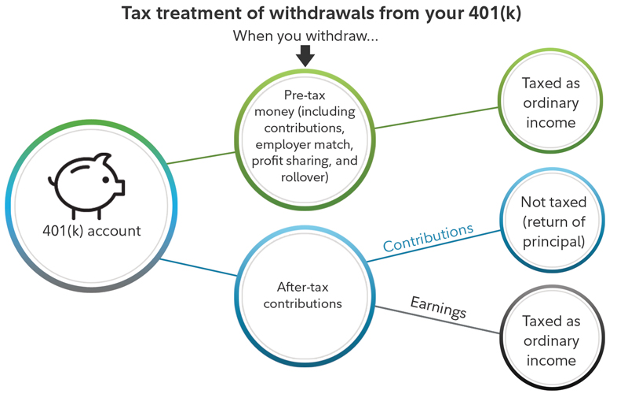

4. 401k

A good way to receive additional money and tax deductions is by opening and managing a 401k. While these retirement accounts are usually distributed by employers, even self-employed individuals can open their own accounts. With the 401k, the IRS does not tax the money you directly move from your paycheck to the 401k account which if done consistently, can provide many different advantages. Throughout 2020 and 2021, individuals could accumulate up to nearly $20,000 towards their retirement savings which cannot be taxed, each year. To add a bonus, some employers even match contributions made which can double the money that is invested in your retirement, and receive additional nontaxable income. So if your employer offers a 401k opinion, take it and set aside money that will not be taxed and will help secure stability for your future.

Tax treatment of 401k withdrawals.

5. IRAs

If your employer does not offer a 401k or any other employer-sponsored savings plans, individuals can still qualify to create an individual retirement account (IRA). There are two major types of IRAs, a traditional IRA and a Roth IRA. A traditional IRA has contributions that are tax-deductible and how much you can deduct is dependent on if you or your spouse is already covered by a retirement plan from an employer and how much you both make. Earnings through this investment grow tax-deferred, meaning a taxpayer can delay paying taxes until some future point. The tax advantage of a Roth IRA is the retirement withdrawals will not be taxed as you pay your taxes upfront and any contributions are unable to be tax-deductible as Roth IRA earnings grow tax-free. Below shows each account in its action for a better understanding.

|

Roth IRA

|

Traditional IRA

|

|

| Contribution Limit |

$6,000 in 2021 and 2022 ($7,000 if age 50 or older) |

$6,000 in 2021 and 2022 ($7,000 if age 50 or older) |

| Key Pros |

|

|

| Key Cons |

|

|

| Early Withdrawal Rules |

|

|

6. Plan Ahead for the Next Tax Season

This is a very simple tip, but most people are still only thinking about their taxes when it is time to file their returns. Consulting your tax return throughout the year can be a powerful tool to help you make good financial decisions. It also allows you to keep always on top of your financials and be ready for when tax season comes around.

7. Know What Documents You'll Need

Tax Season can be an overwhelming time of the year. Knowing what documents will be required from you to file your taxes will help to decrease this overwhelming feeling. First, analyze your own situation, what services you might need, and how you will file for your taxes. Once you have an idea of things you will need to file, collect these documents and keep them in a safe place until it is time to file for taxes. Also, know what records you have to keep.

8. Meet with a Tax Specialist

A great way to maximize your tax planning is by meeting with a tax professional. They will be able to assist you with any questions, the right documentation you will need, and find ways to maximize your tax returns as well. This tip is great for those who do not want to fully understand their taxes but still want to assure all the required information is being provided. Your tax specialist will be able to guide you through the whole tax preparation process.

About the Authors

Sthephany Coutinho is an XYTS Operations Intern. She enjoys working with processes and maximizing efficiency. Sthephany also loves traveling and learning new skills, especially new languages.

Tre Talton is an Operation Intern with XPYN Team, XY Tax Solutions, as he enjoys running daily operations to keep a consistent flow of business processes and looks to find ways to strategize those processes to become more efficient and effective. When not at work, Tre enjoys staying healthy and active through designed exercises and sporting activities - especially basketball.

Share this

- Advisor Blog (727)

- Financial Advisors (249)

- Growing an RIA (129)

- Business Development (101)

- Digital Marketing (97)

- Marketing (94)

- Community (82)

- Start an RIA (77)

- Coaching (76)

- Compliance (73)

- Running an RIA (72)

- Client Acquisition (68)

- Technology (67)

- Entrepreneurship (64)

- XYPN LIVE (64)

- Fee-only advisor (51)

- Sales (49)

- Bookkeeping (46)

- Client Engagement (45)

- Practice Management (44)

- Scaling an RIA (43)

- XYPN Books (43)

- Investment Management (41)

- Financial Education & Resources (36)

- Client Services (31)

- Employee Engagement (31)

- Lifestyle, Family, & Personal Finance (31)

- Market Trends (31)

- Journey Makers (26)

- Process (18)

- Niche (13)

- SEO (9)

- Career Change (8)

- Partnership (8)

- Sapphire (7)

- Transitioning Your Business (7)

- Emerald (4)

- Persona (4)

- Social Media (4)

- Transitioning To Fee-Only (4)

- Transitioning Clients (3)

- Onboarding (2)

- RIA (2)

- Transitioning to a Corporate RIA Affiliation (1)

Subscribe by email

You May Also Like

.png?width=360&height=188&name=BLOG%20IMAGES%20TEMPLATE%20(14).png)

The Ultimate 2021 Guide to Year-End Tax Planning as an Advisor

Dec 6, 2021

11 min read

Roth Conversions: Everything You Need to Know as an Advisor

Jul 19, 2021

9 min read

.png?width=360&height=188&name=BLOG%20IMAGES%20TEMPLATE%20(25).png)