These Related Stories

Questions to Ask Before Integrating Investment Management into Your Planning Firm

Share this

There are a LOT of moving parts and considerations when integrating investment management into your firm. You might consider questions like:

- What’s my overarching philosophy?

- How will I charge?

- What technology and tools am I going to use?

- How will I integrate my message and story?

- Maybe I should use those bulletshares?

- Oooohhhooo, a new smart beta fund?!?

You know...all those things advisors love to pontificate on in forums, webinars and panels at conferences.

This post is not about any of that.

There’s a WHOLE other conversation around just getting your firm set up so you can actually place a trade in a client's account and get paid to do so! And while none of this is overly complicated, there are a few key decision points that have tremendous impact on your firm and client experience, yet many advisors either lack understanding (it’s not something anyone teaches anywhere) or they neglect the question (it’s not as fun as discussing the latest tweet from Josh Brown).

In our experience, one of the below points (if not more than one) is a bit elusive for many advisors:

- Discretion vs. Non-Discretion

- Wrap vs. Non-Wrap

- Transaction-Based Pricing vs. Asset-Based Pricing

We think we understand, then once we dig in a bit more we find ourselves asking more and more questions. And that’s OK! You’re job is making sure your clients have an amazing financial life. Our job is helping you understand how to make that happen in the best manner possible!

But before we dive in, let’s establish a few things:

For purposes of this blog, let’s assume you’ve already made the decision to utilize investment management, elected a custodian, chosen the right fee structure, and are ready to start the process of getting your ADV and advisory documents ready for prime time.

Secondly, KNOW YOUR NICHE (it’s Gen XY) and your target client and set up your structure based on that target client. This will help inform many of the decisions you will need to make and enable you to give a targeted experience for those clients. Otherwise, your mind is going to get stuck in a circular reference of, “but if they want to do this, that would be best. Or, if someone wants to do that, we could set it up this way.” Design your experience, pricing and value matrix for your target...forget everyone else.

Decision #1 - Discretion vs. Non-Discretion

While we have written about this before, it’s good to reiterate a few of the key points. The first being, what exactly is “discretion”. What “having discretion” means is that the client has given the advisor authority to act on their behalf within agreed-upon and well-documented guidelines without contacting or getting approval from the client. Many advisors and clients miss the “agreed-upon and well-documented” piece of discretion. “Non-discretion” means that before taking any action in a client’s account, the advisor must obtain permission or authority to do so.

While there are pros and cons to each, most RIAs and advisors being paid by clients to manage their investment portfolios elect to manage client portfolios in a discretionary manner. This makes life easier on everyone. It allows the advisor to run and manage their firm in a highly scalable manner. For clients, they always know that when an advisor needs to make a change, it will happen as effectively and efficiently as possible without any disruption to their life. Another key point: if you want to utilize outsourced investment management options, such as a TAMP or other option, you will need to have discretionary authority.

With non-discretionary accounts, firms must maintain “trade blotters” and client records that indicate each authorization and permission for the action within the client accounts. While technology has made this much easier, it must still be documented via client notes or CRM.

One of the big hang-ups advisors have with discretion is this:

“I want to have a highly personalized experience and relationship with my clients and always let them know what’s going on in their accounts prior to it occurring.”

For which we ask, “In that case, who are you calling first and who are you calling last when you need to make a change and the market is moving faster than you can communicate the change to all your clients?”...which seems to be a more frequent occurrence these days. Now that is somewhat in jest but there’s considerable reality to it as well. To remedy this, we suggest making the change, then sending a note to all of your clients on what occurred, the reasoning, and how you acted in their best interest. Remember, discretion doesn’t mean you can do anything. Clients are giving you authority to act within “agreed upon and documented guidelines”, not to swap out your S&P 500 index fund for Bitcoin.

Decision #2 - Wrap vs Non-Wrap

Before we get too deep into this, let’s just call it for what it is:

Wrap = costs are “bundled” into a singular cost or fee to the client

Non-Wrap = costs are “unbundled” and paid separately

What costs you ask? Typical costs would be trade costs, custody fees, investment platform or TAMP costs, outside or separate manager fees, and, of course, your advisory fee as the manager of the account.

We say, “call it for what it is,” because historically there has been a misconception and even some bad connotation around “wrap fees”. While wrap fees are often associated with wirehouses and brokerage firms (and the high costs sometimes seen with them), the reality is that many fee-only RIAs use wraps fees in a very efficient and cost effective manner. Remember, all “wrap” means is that the costs are “wrapped” in a singular cost for the client, who many appreciate the simplicity.

The decision for advisors is this:

“Do I want to charge my clients a singular cost or do I want to show each cost separately?”

A singular cost offers ultimate simplicity and ease for the clients. However, many advisors want clients to have ultimate transparency and prefer to bill everything separately. While we are outwardly big proponents of transparency, this doesn’t mean that non-wrap is the way to go for all fee-only advisors. Simplicity matters to clients and when considering the overall client experience, many would prefer a simple singular fee. So, have a wrap fee that includes everything and then feel free to break out costs in any way you chose as you introduce clients to your investment management services.

Which brings us to our final decision!

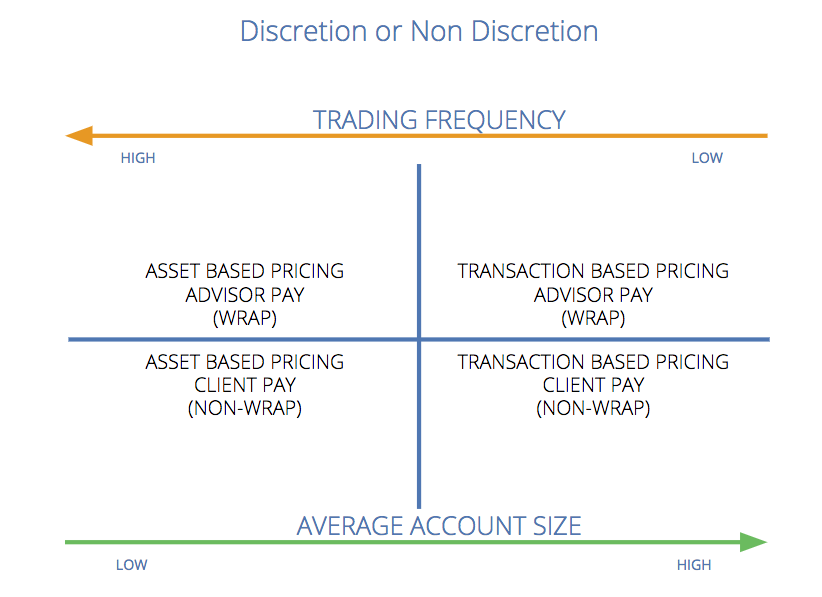

Decision #3 - Transaction Based vs Asset Based Pricing

Since this is investment management, we presume there will be some transaction or trade costs. While we recognize there are many platforms and advisors that utilize “no transaction fee” funds (NTF), it’s safe to say there will come a time when you will have to utilize something with a transaction cost either due to a client transferring in assets or even a custodian shaking up their NTF platform, which we anticipate will start happening more and more as we move into a more pay-to-play environment.

But WHO should pay for those and HOW should they pay? Well, since we now know the difference between wrap and non-wrap:

Wrap = Advisor pays transaction costs

Non-Wrap = Client pays transactions costs

It’s the “HOW” that is sometimes a bit of a surprise to many advisors. There are two types of transaction costs typically utilized with RIAs:

- Transaction-Based Pricing (TBP)

- Asset-Based Pricing (ABP)

Virtually everyone is familiar with Transaction-Based Pricing. When an investment vehicle is bought or sold, there is a transaction cost - either per transaction or per share (example - $6.95 per trade).

Lesser known is what is called Asset-Based Pricing. ABP is similar to an advisory fee and utilizes basis points or a percentage of the value of the portfolio as opposed to a transaction cost. ABP is typically utilized in wrap accounts, though not exclusively, and offers unlimited trading for a singular cost. This is very beneficial for advisors in two major ways. First, trade costs become irrelevant in the decision-making process and there’s no need to be beholden to non-transaction fee funds when attempting to be efficient with client accounts. Secondly, it brings stability to advisor costs if you are operating in a wrap manner and covering the trade costs for your clients. Let’s say your ABP is 10 basis points (bps). You know each quarter your costs are going to be 2.5 bps per quarter. Good to know when running your business!

Now, there are a couple of MAJOR considerations when selecting either TBP or ABP.

- Trading frequency (and anticipated inflows and outflows)

- Size of your accounts

While pretty self-explanatory, it’s good to walk through the various scenarios before selecting which method works best.

The higher your trading frequency, the more attractive ABP becomes. However, the larger your accounts, TBP looks better. And vice versa.

Now, many fee-only RIAs that lead with planning utilize a more passive and strategic approach to investing and look to utilize the most cost-effective vehicles to do so. And while many may still believe in a more active approach, they may do so using actively managed mutual funds or more factor-based ETFs that may actively trade within the investment vehicle, there’s not typically a large number of “trades” that would consummate a transaction cost.

To lend some perspective, at XY Investment Solutions, we tell prospective advisors to anticipate approximately 2-3 rebalances per year in a normal market environment. If on average we have 8 - 12 holdings in each of our accounts, that would be anywhere from 16 - 36 trades per year. Thus, do some simple math by multiplying 36 trades by your average trade cost ($7-$10 per trade based on investment vehicle) and there you have it! On average it will cost between $250 - $350 per account.

BUT...what if your target client is a younger, net contributor to their accounts?!? And that’s why you need to know our target client!

Easy, Right?

While it’s not quite black and white, the better you understand each of the various costs and structures, the easier it becomes to make an informed decision. And don’t forget: the more specific you can hone in on your target client or niche, the better you can tailor your cost structure to be beneficial to both your firm and most importantly, your clients!

And to make the decision just a bit easier, check out this decision matrix and always feel free to reach out with questions!

About the Author

For those I haven’t met yet, “Hello, I’m Brandon Moss”, and I’m the Director of XY Investment Solutions (XYIS), XY Planning Network’s digital hybrid investment platform. It’s a turnkey asset management platform (TAMP) designed and curated to the specific needs of XYPN members (sales pitch over, kind of).

Visit XY Investment Solutions

This information is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, XY Investment Solutions, LLC (referred to as "XYIS") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. XYIS does not warrant that the information will be free from error. None of the information provided is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall XYIS be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if XYIS or an XYIS authorized representative has been advised of the possibility of such damages. In no event shall XY Investment Solutions, LLC have any liability to you for damages, losses and causes of action for this information. This information should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.

Share this

- Advisor Blog (727)

- Financial Advisors (249)

- Growing an RIA (129)

- Business Development (101)

- Digital Marketing (97)

- Marketing (94)

- Community (82)

- Start an RIA (77)

- Coaching (76)

- Compliance (73)

- Running an RIA (72)

- Client Acquisition (68)

- Technology (67)

- Entrepreneurship (64)

- XYPN LIVE (64)

- Fee-only advisor (51)

- Sales (49)

- Bookkeeping (46)

- Client Engagement (45)

- Practice Management (44)

- Scaling an RIA (43)

- XYPN Books (43)

- Investment Management (41)

- Financial Education & Resources (36)

- Client Services (31)

- Employee Engagement (31)

- Lifestyle, Family, & Personal Finance (31)

- Market Trends (31)

- Journey Makers (26)

- Process (18)

- Niche (13)

- SEO (9)

- Career Change (8)

- Partnership (8)

- Sapphire (7)

- Transitioning Your Business (7)

- Emerald (4)

- Persona (4)

- Social Media (4)

- Transitioning To Fee-Only (4)

- Transitioning Clients (3)

- Onboarding (2)

- RIA (2)

- Transitioning to a Corporate RIA Affiliation (1)

Subscribe by email

You May Also Like

Considerations for Discretionary vs. Non-Discretionary Investment Management

Mar 1, 2017

4 min read

.png?width=360&height=188&name=BLOG%20IMAGES%20TEMPLATE%20(60).png)

Do You Offer Direct Indexing Yet? What You Should Know as an Advisor

Jul 11, 2022

6 min read