Good Financial Reads: Expert Advice on How to Better Navigate Investing

Share this

Have an Investment Philosophy

by Joe Morgan, Best Financial Life

Here’s how most people invest:

- Act on impulse

- React to things they see in the news

- Do what their friends are doing

- Do their own research and convince themselves they can see what the future holds

- Bet their life savings on tips and hunches.

Don’t be like most investors!

What’s missing is an Investment Philosophy. This is something we expect to be true in all markets and in all economic times. It’s something that drives a logical investment strategy even when it seems all logic has fallen out of the markets.

Strategic Planning: Investment Management

by Eric Roberge, Beyond Your Hammock

The right investment strategy is critical to growing your wealth over time.

We talk through what you need to do to put together a sound investment strategy for yourself, and the to-dos any investment manager should take (whether that’s you as a DIYer, or an advisor who you hire to manage your assets for you).

This episode covers:

- Assessing risk tolerance and risk capacity (and the difference between the two)

- Understanding your investment time horizon

- Allocating your assets correctly (which does NOT just mean what percentage of your portfolio should be in stocks vs. bonds)

- Selecting investments and coordinating account types

- Diversifying your investments – in all kinds of ways! Diversification of specific assets, across asset classes, with the specific vehicles you use (and what specific assets you put into each account or vehicle you use)

- Considering tax impacts of your investment choices (and the tax planning you should do for your investment portfolio)

- Calibrating your portfolio for the return you need (which includes knowing reasonable return expectations)

- Remembering fees and expense ratios – and other basics like rebalancing

- Explaining why tax loss harvesting is not right for everyone (sorry)

- Doing ongoing due diligence to understand if and when you should replace assets in your portfolio

- Choosing contribution strategies

- Setting up standard rules to guide your ongoing decisions and complete maintenance over time

Ultimately, you should understand your investment strategy and why you set it, so you can stick to it when things get wonky in the markets (which is inevitable over time).

And that brings us to our most important strategic planning advice for going through the process of setting up an investment management system that works for you:

A good strategy, stuck with over time, is better than the “best” strategy you found only after trying multiple different things and interrupting your progress with each change.

Five Behaviors That Diminish Your Investment Returns

by Michael Reynolds, Elevation Financial

Investing is both an art and a science. The science part is driven by understanding the fundamentals and applying technical principles to your strategy. This may seem like the hard part, but often it's the other side of the coin that proves more difficult.

The "art" side of investing can be challenging because it's driven by behavior and emotions.

From 2001 - 2020, the S&P 500 has returned 7.5%. However, according to research by JP Morgan, the average investor has achieved only 2.9% in returns in that same time period. Why is that?

Behavior.

It's usually not some specific technical decision that diminishes investment returns. It's human behavior.

Here are five behaviors that can suppress investment returns:

- Stopping your recurring contributions when the market goes down

- Moving your investments to cash based on fear

- Chasing the latest shiny object

- Accepting “default” suggestions

- Buying high and selling low

So You Want to Make a Speculative Investment

by Eric Roberge, Beyond Your Hammock

A broad-based, globally diversified portfolio is hands-down the right answer when it comes to growing wealth for the long term. But that doesn’t mean other, more speculative and risky investments are always a bad move…

They’re just not a great idea most of the time.

Today, we’re looking at some alternative ways to invest outside of a globally diversified portfolio, including stock-picking, placing sector bets, private equity and private placement investments, and more.

Generally speaking, these kinds of vehicles are big no-nos for most people. Although it’s easy to get swept up into the allure of hitting a home run and scoring an outsized return, the reality is most people swing and miss with investments like this.

In fact, speculative bets are just that: bets in the market, and your odds of winning big are usually not in your favor.

That doesn’t mean you can’t ever explore investing outside of your trusty diversified portfolio designed to build wealth over the long run, but you must understand all the caveats, pitfalls, and risks you take when you reach out from that core strategy.

In this episode, we explain:

- Why most people can’t afford to take on speculative investments, even if they promise the potential for a big return

- What you must consider the next time you hear about a “too good to be true” investment opportunity (hint: it sounds too good to be true because it’s too good to be true)

- The questions to ask yourself before you walk out on a limb and take a big risk with an alternative investment

- The checklist you should be able to complete before you even think about putting your money into high-risk vehicles, as well as helpful rules and guidelines to follow if you want to explore these risky options

If you’re curious about investments beyond your globally diversified stock market portfolio, this episode will help you better understand the options that are out there… and why there is no easy way to wealth when it comes to building it yourself.

From Vanilla to Rocky Road – Navigating the Transformation & Risks of the S&P 500 Index

by Brett Spencer, Planning Impact

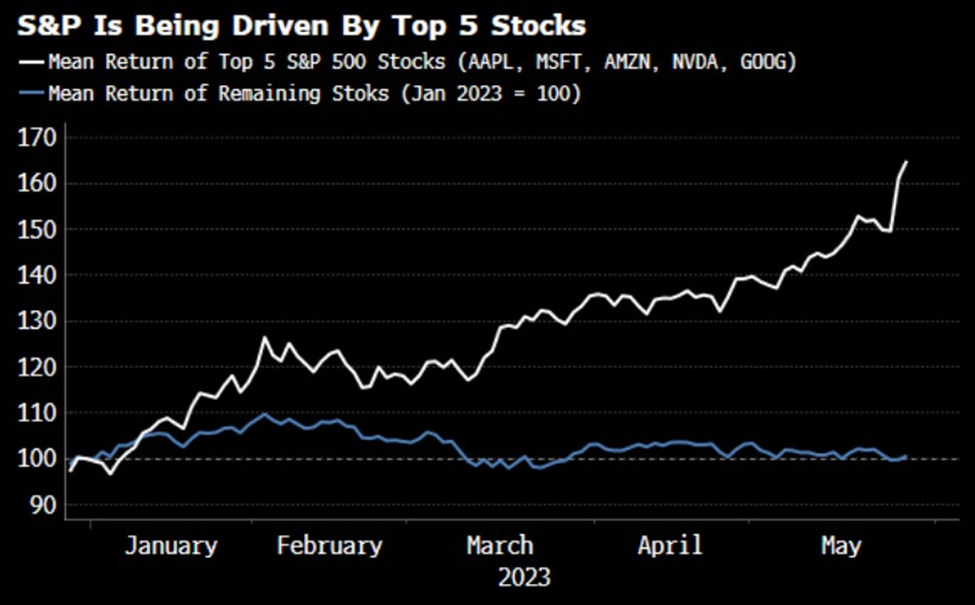

2023 has been quite an interesting year so far. Markets have been up, which is a nice change after a down year. But this has all been during the steepest rate hikes we’ve ever had in US history and we aren’t out of the “recession worry” woods quite yet. While positive performance is always welcomed, it’s important to understand where performance is coming from before we blindly trust what the market is telling us.

The S&P 500 for example has been a leading performer year-to-date, returning 16.9% in just the first 6 months. This performance however has been driven by only a select few stocks. And the index has become much more concentrated than historic norms. Given how common and relied upon this index is (as either an investment or a benchmark), it’s important that we understand the risks and significance of its performance.

The chart below illustrates just how impactful the top 5 stocks in the S&P 500 index have been:

This is remarkable!! The index is composed of 500 stocks and yet only 5 stocks are the primary drivers of return!

Following along with the blogs of financial advisors is a great way to access valuable, educational information about finance — and it doesn’t cost you a thing! Our financial planners love to share their knowledge and help everyone regardless of age or assets.

Share this

Subscribe by email

You May Also Like

These Related Stories

Good Financial Reads: How to Diversify and Rebalance to Manage Risk

Good Financial Reads: Optimize Your Investment Portfolio