Retirement Savings and the Millennial Generation

Share this

Are you a millennial and wish that you had more (or anything) saved for retirement? If so, you're not alone. A shocking 80% of millennials are not invested in the stock market! This is a major problem, but thankfully there is still plenty of hope for millennials and their retirement.

What’s Causing Millennial’s Problems?

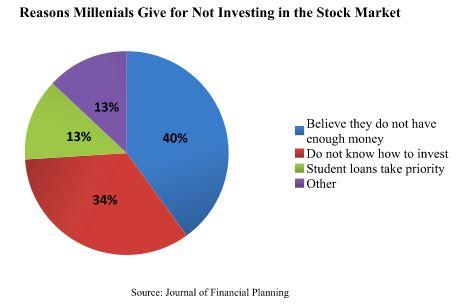

Student loan debt is unsurprisingly a major foe to millennials and their retirement savings, but this isn’t the only thing getting in the way. The fear of another market crash still lingers from nearly a decade ago. Other barriers include the belief that they don't have enough income to be able to invest, and with it lack the education or understanding of where to even start. The chart below illustrates to which of these obstacles are most prevalent for millennials:

Reasons to Have Hope

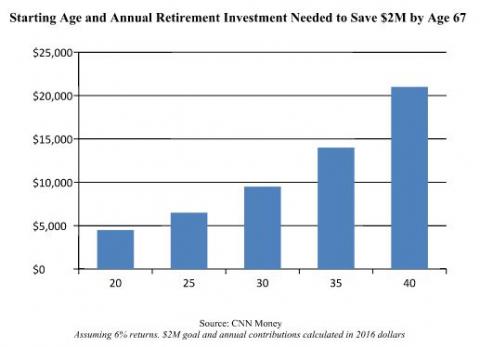

No doubt there are legitimate challenges with retirement savings that are unique to the millennial generation. These can make saving one of the benchmark millennial retirement goals of $2 Million seem daunting. Thankfully, millennials also have more of one important asset remaining than do any generations that have gone before them: TIME. A strong financial plan can leverage time to build a healthy nest egg in the long run. The figure below illustrates the importance of getting started early:

Virtually everyone will agree that building towards a healthy financial future is inherently important. Interestingly, millennials tend to have different motivators towards retirement than other generations. From the same survey cited earlier, 84% of millennials view making an investment that leads to positive social impact as a key goal. As believers in Christ, we are called even further with how we view our retirement.

It is important that we not live in fear and instead stay eternally focused by making a plan to save for the future. Proverbs 21:5 reminds us that “good planning and hard work lead to prosperity” (NLT). We save not for our own security, but in order to be even more generous with our time and resources in the years ahead. See last month’s post titled Is Retirement Biblical? for a further exploration into this topic.

It is Time to Get on the Right Financial Path

Eternally focused is the mantra of Wacek Financial Planning. The majority of the clients I work with are millennials. The most prevalent topics we discuss are how to pay off debt while saving for retirement. While there are more than 70,000 Certified Financial Planners in the world today, only 1 in 10 are millennials themselves. Much fewer yet would say that faith drives the financial advice they give. This puts me in a unique position to help overcome the challenges facing the millennial generation and to do so from a biblical perspective. If you'd like to take advantage of the time that you have on your side and save more for the future, reach out to me at Wacek Financial Planning. Together, let’s put a financial plan in place that gives you confidence in your future!

This post originally appeared on Wacek Financial Planning.

About the Author: This post originally appeared on Wacek Financial Planning. Ben Wacek is a fee-only, Certified Financial Planner™ who has a passion to help people of all income levels make wise financial decisions and steward their resources from an eternal perspective, using Biblical principles. If you’d like to learn more about Ben or Wacek Financial Planning, please visit www.wacekfp.com.

About the Author: This post originally appeared on Wacek Financial Planning. Ben Wacek is a fee-only, Certified Financial Planner™ who has a passion to help people of all income levels make wise financial decisions and steward their resources from an eternal perspective, using Biblical principles. If you’d like to learn more about Ben or Wacek Financial Planning, please visit www.wacekfp.com.

Share this

Subscribe by email

You May Also Like

These Related Stories

30-Somethings: Why are You Wasting Time Following the Stock Market?

7 Tax Tips Every Entrepreneur Should Know